Table of Contents

TogglePlasticshark – TOR Scam Report (1)

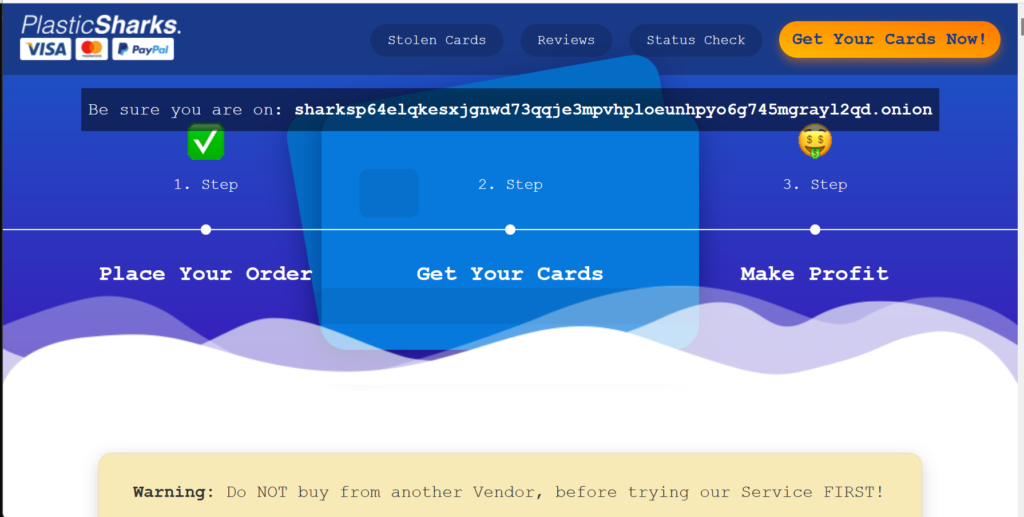

Onion Link: http://sharksp64elqkesxjgnwd73qqje3mpvhploeunhpyo6g745mgrayl2qd.onion

Scam Report Date: 2024/06/23

Client Scam Report Breakdown

Original Report Summary:

Carding Scam after Transferring BTC – No Response

Photos:

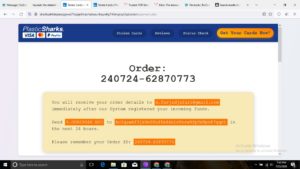

In this report, the client described their experience of falling victim to a carding scam after transferring Bitcoin to a vendor known as Plastic Sharks, an alleged provider of stolen card data, including Visa, MasterCard, and PayPal information. According to the scam report, the client transferred Bitcoin to the specified address but received no communication or product in return, despite the vendor’s promises of instant fulfillment and tracking numbers. The client was attracted by the vendor’s claims of insider access to stolen card data from large databases and promises of clean and resellable information. Plastic Sharks, in their promotional material, emphasized that they were different from typical carding scams by claiming to offer direct access to “clean” data from a company’s internal databases. This misleading claim gave the impression that their services were more reliable and risk-free than others in the marketplace, which contributed to the client’s trust.

The scam itself falls under the broader category of carding – a fraudulent act where criminals use stolen credit card information to make unauthorized purchases or withdraw cash. However, in this case, it was the act of selling fake or non-existent card information to unsuspecting buyers that constitutes the scam. Carding marketplaces like Plastic Sharks often leverage techniques such as phishing, skimming, and spyware to gather credit card data. Phishing involves deceiving victims into providing sensitive information by pretending to be legitimate entities (e.g., banks or service providers), while skimming uses electronic devices to steal card information when a card is swiped, typically at ATMs or gas stations. Although Plastic Sharks claimed not to rely on these techniques, preferring to market themselves as insiders with unlimited access to fresh card data, the outcome was the same—a fraudulent transaction where the client was scammed out of Bitcoin without receiving any product or service.

The Plastic Sharks vendor cleverly enticed buyers by promising a “How-To Guide” on safely cashing out the cards they claimed to sell, stressing the importance of following their specific instructions. The scam report highlights that Plastic Sharks offered escrow services, a feature that could give buyers a false sense of security. Escrow is a system in which funds are held by a third party until both parties agree the transaction is complete. In theory, this should protect buyers from fraud; however, the scam report suggests that this option was either not available or ineffective in practice. Moreover, Plastic Sharks emphasized their data being “clean”—not previously resold—insisting that this minimized the risk of detection. However, the original scam report shows how these reassurances were part of the vendor’s ploy to gain trust, as the client’s payment was made, but the product and service were never delivered. This is a classic example of an exit scam, where vendors in illegal marketplaces disappear after receiving funds without fulfilling orders. The client’s experience underscores the need for heightened vigilance when engaging in darknet transactions, particularly with vendors that offer deals that seem too good to be true.