Table of Contents

ToggleDeep Market – TOR Scam Report (3)

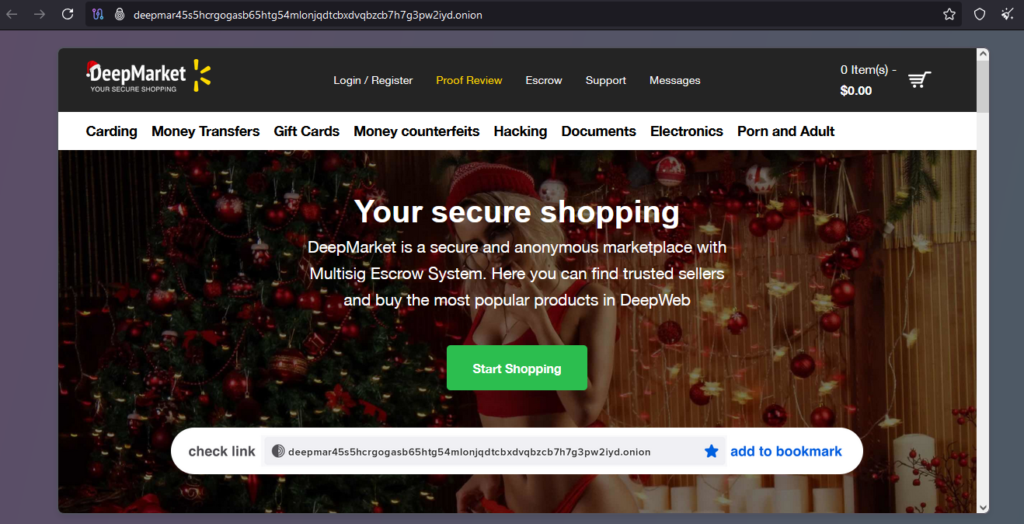

Onion Link : http://deepmar45s5hcrgogasb65htg54mlonjqdtcbxdvqbzcb7h7g3pw2iyd.onion/

Scam Report Date : 2024-11-08

Client Scam Report Breakdown

Original Scam Report :

The client reported losing $300 across transactions with two vendors on an online platform. Initially believing the vendors to be independent sellers, the client later discovered that the site was operated entirely by scammers. This revelation explained why the platform’s escrow service, which is designed to mediate transactions and provide a safety net, was non-responsive. Instead of ensuring secure transactions, the escrow service was a part of the scam, creating an illusion of security to lure victims. This incident demonstrates the premeditated and systemic nature of fraud on scam-operated platforms, where multiple roles (vendor, platform operator, and escrow mediator) are controlled by the same malicious actors.

Definitions and Terminology

- Escrow Service: A system in which a neutral third party holds funds during a transaction, releasing them only when both parties fulfill agreed-upon conditions. On legitimate platforms, escrow systems build trust by minimizing the risk of fraud. However, scam platforms often set up fake escrow services to deceive users.

- Vendor Accounts: User accounts on marketplaces or platforms used to sell products or services. Fraudulent platforms often create multiple vendor accounts to appear legitimate while increasing opportunities for theft.

- Scammer-Operated Platform: A fraudulent online marketplace or site that appears legitimate but is entirely controlled by scammers. These platforms often feature fake vendors, manipulated reviews, and fabricated security measures like escrow services.

- Non-Responsive Escrow: A hallmark of scam platforms where the escrow service, supposedly a neutral intermediary, becomes unreachable, ensuring victims cannot recover their funds or seek mediation.

- Illusion of Security: A tactic employed by scammers to make a fraudulent platform appear credible. This can involve professional website design, fake customer support, or bogus escrow guarantees to earn users’ trust.

In this case, the scammers exploited the client’s trust in the platform and its escrow system. By controlling every aspect of the transaction, they ensured there was no accountability or possibility for recourse. The non-responsiveness of the escrow service was a key indicator that the platform was fraudulent.

Analysis and Recommendations

This case underscores the importance of due diligence when conducting transactions on online platforms, especially those with less-established reputations. To minimize the risk of falling victim to similar scams, users should consider the following strategies:

- Research Platform Credibility: Before engaging with any platform, verify its legitimacy through independent reviews, user feedback, and scam warnings. Fraudulent platforms often have negative reviews or lack a significant online presence.

- Test Escrow Responsiveness: If possible, perform a small, low-stakes transaction to test the functionality and reliability of the platform’s escrow system. Delays or unresponsiveness are red flags.

- Analyze Vendor Activity: Examine vendor profiles carefully. Newly created accounts, vague product descriptions, or a lack of reviews are common traits of fraudulent vendors.

- Report Suspicious Activity: If scammed, report the incident to relevant authorities and warn others by sharing your experience on forums or consumer protection sites. This helps prevent others from becoming victims and can aid in investigations.

- Seek Established Platforms: Stick to well-known marketplaces with established reputations and verified vendor systems. Trusted platforms often have more robust fraud prevention mechanisms.

The client’s experience of losing $300 highlights how scam platforms manipulate users by creating a sophisticated web of deception involving multiple fake vendor accounts and a bogus escrow system. The scammers rely on users’ trust in these seemingly secure systems to execute their fraud. By educating users about these tactics and promoting critical evaluation of online platforms, we can help reduce the success rate of such scams.

Ultimately, combating these scams requires a combination of user awareness, better reporting mechanisms, and stricter enforcement against fraudulent platforms. The responsibility also lies with legitimate marketplaces to continually improve their security measures to stay ahead of evolving scam techniques.