Table of Contents

ToggleBest Carding World – TOR Scam Report (192)

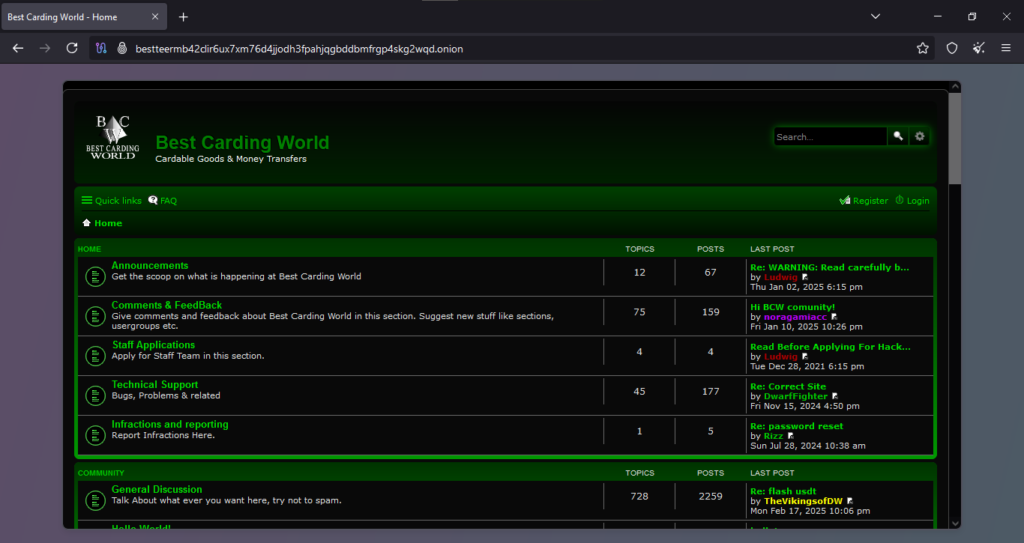

Onion Link : http://bestteermb42clir6ux7xm76d4jjodh3fpahjqgbddbmfrgp4skg2wqd.onion/

Scam Report Date : 2025-02-18

Client Scam Report Breakdown

Original Scam Report :

The client recounts their experience with a marketplace known as BCW, specifically regarding an escrow service offered on the platform. The original scam report describes the interaction between the client and various actors, including “Mr. Gardner,” “Mangus,” and the “Escrowman.” The process began when the client observed a similar transaction involving Mr. Gardner and Mangus. According to the report, Gardner’s post described a back-and-forth exchange where the Escrowman verified receipt of funds and instructed Mangus to begin work. Gardner later confirmed that the work was completed and the transaction was marked as finished. Inspired by this, the client proceeded with a similar deal, following the same procedure: the Escrowman asked for a payment to be made to a specified address, including a fee for the escrow service. After transferring the funds, the client received similar assurances from both the Escrowman and Mangus about the completion of the deal, but shortly thereafter, the client found their account locked, with no further responses from the platform’s admin. The client soon discovered a fraudulent post under their name, marking the transaction as “completed” and the thread was closed, signaling that the transaction was part of a scam.

Defining Terminology and Key Terms:

Several important terms and concepts appear throughout this report, and it’s essential to define them for clarity. First, “escrow” refers to a financial arrangement where a third party (in this case, the Escrowman) temporarily holds funds on behalf of two parties involved in a transaction. The purpose of this service is to ensure that both the buyer and seller fulfill their obligations before money is transferred. In the context of the report, the Escrowman acts as an intermediary to ensure that payment is made and work is started before finalizing the deal. The term “PM” refers to a private message, typically used for communication that isn’t visible to the broader community or forum. This private channel was used to send payment instructions and other details between the client and the involved parties. In online marketplaces, these terms are common, but when associated with scams, they can be misleading or manipulated to create the appearance of a legitimate transaction.

The escalation of the scam is marked by the client’s sudden inability to log into their account, a common red flag in online fraud schemes. The report also highlights the role of the admin in maintaining oversight of the platform and resolving disputes. The lack of response from the admin after the client’s inquiry regarding the locked account further supports the notion that the platform may have been complicit or negligent. Additionally, the final fraudulent post in the forum, made under the client’s name and closing the thread, reinforces the deceptive nature of the scam. This post falsely marked the transaction as “complete,” which, in the context of online fraud, is an attempt to give the illusion of a successful exchange and close the case without any further action being taken. These actions are a key part of how scammers exploit the platform’s infrastructure to steal funds.

Analysis of the Fraud Scheme:

The scam follows a typical pattern seen in fraudulent online marketplaces, where scammers use trust-building tactics to manipulate victims into making payments. Initially, the victim is introduced to the concept of escrow, which is often associated with security and safety in online transactions. However, the scammer’s manipulation begins when they replicate seemingly legitimate transactions, such as the one involving Mr. Gardner and Mangus, to create a false sense of confidence. By echoing similar communications, including the confirmation of funds and the initiation of work, the scammer aims to convince the victim that the process is safe and genuine. Once the victim sends their payment, the scammer locks their account, cuts off further communication, and fabricates proof of transaction completion. This staged “closure” of the thread and the fraudulent post under the victim’s name is designed to give the illusion of finality and deter any further investigation into the scam. This type of scheme demonstrates the dangers of interacting with unverified escrow services in illicit marketplaces, where the risk of being defrauded is high, and the lack of platform accountability amplifies the likelihood of victimization.