Table of Contents

ToggleBlack mart – TOR Scam Report (1)

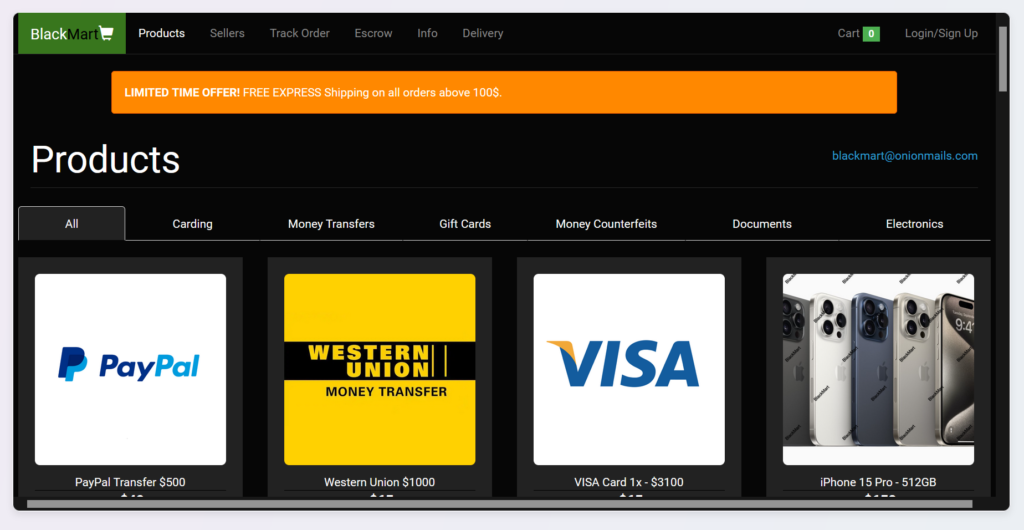

Online Link: http://blackma333zetynnrblc7uidfp2tewhtwpojxxvmty3n4cdsc7iyukad.onion

Scam Report Date:

Client Scam Report Breakdown

Original Scam Report:

The original scam report highlights three main issues encountered by the client: uncredited Bitcoin deposits, fake reviews, and lack of communication. The client states, “They aren’t crediting BTC deposited. They also have fake reviews which made me believe it. They aren’t replying to my emails as well.” This concise summary encapsulates the client’s frustrations and the fraudulent activities of the entity in question. The absence of BTC (Bitcoin) credits, coupled with the presence of deceptive reviews and unresponsive customer service, paints a clear picture of the scam’s structure and impact on the client.

Defining Terminology and Terms

To fully understand the client’s experience, it is important to define key terms mentioned in the report. “BTC” stands for Bitcoin, a type of cryptocurrency that operates independently of a central bank and uses encryption techniques to regulate the generation of units and verify transactions. The client mentions that their Bitcoin deposits were not credited, meaning that the expected transfer of Bitcoin into their account did not occur. This is a significant red flag, as it indicates that the entity may be holding or misappropriating the client’s funds.

The term “fake reviews” refers to fabricated or misleading testimonials that are often used to create a false impression of trustworthiness or quality. In this case, the client was deceived by these fraudulent reviews, leading them to believe that the entity was legitimate. This tactic is commonly employed in scams to build a veneer of credibility and attract unsuspecting victims.

The client’s statement about the entity “not replying to my emails” highlights a lack of communication and customer support, which is a common characteristic of fraudulent operations. Scammers often avoid engaging with their victims once they have taken their money, leaving the victims with no recourse or ability to resolve the issue. The unresponsiveness exacerbates the client’s frustration and sense of helplessness, further confirming the fraudulent nature of the entity.

Detailed Analysis and Implications

Analyzing the report, we can infer several implications and underlying issues. The uncredited Bitcoin deposits suggest that the entity might be involved in a “deposit scam,” where victims are instructed to deposit funds into a scammer’s account under the guise of investment or service provision, only for the funds to be stolen. The presence of fake reviews indicates a premeditated effort to mislead potential clients by creating an illusion of reliability and success. These reviews can be particularly persuasive, as they often feature fabricated stories of positive experiences and financial gains, which can lure victims into a false sense of security.

The lack of response to the client’s emails is indicative of a typical scam behavior, where the scammers cease all communication once they have obtained the victim’s money. This abandonment strategy leaves victims isolated and without support, often leading them to believe that they have no options for recourse. It also prevents the victim from gathering further information about the scam or attempting to recover their funds.

In conclusion, the client’s scam report sheds light on a common fraudulent scheme involving uncredited Bitcoin deposits, fake reviews, and unresponsive communication. By understanding the terminology and tactics used in this scam, potential victims can better recognize and avoid similar situations. It is crucial for individuals to conduct thorough research and due diligence before engaging in financial transactions, especially in the cryptocurrency space, where scams are prevalent. Additionally, reporting such scams to relevant authorities and online platforms can help prevent others from falling victim to similar fraudulent activities.