Table of Contents

ToggleBlack Wallet Shop – TOR Scam Report (37)

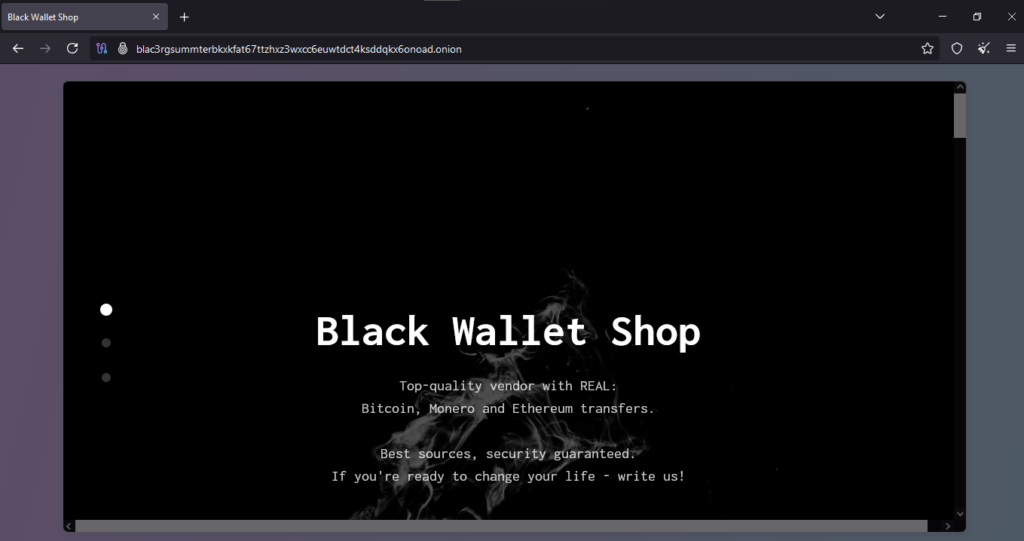

Onion Link : http://blac3rgsummterbkxkfat67ttzhxz3wxcc6euwtdct4ksddqkx6onoad.onion/

Scam Report Date : 2024-11-22

Client Scam Report Breakdown

Original Scam Report :

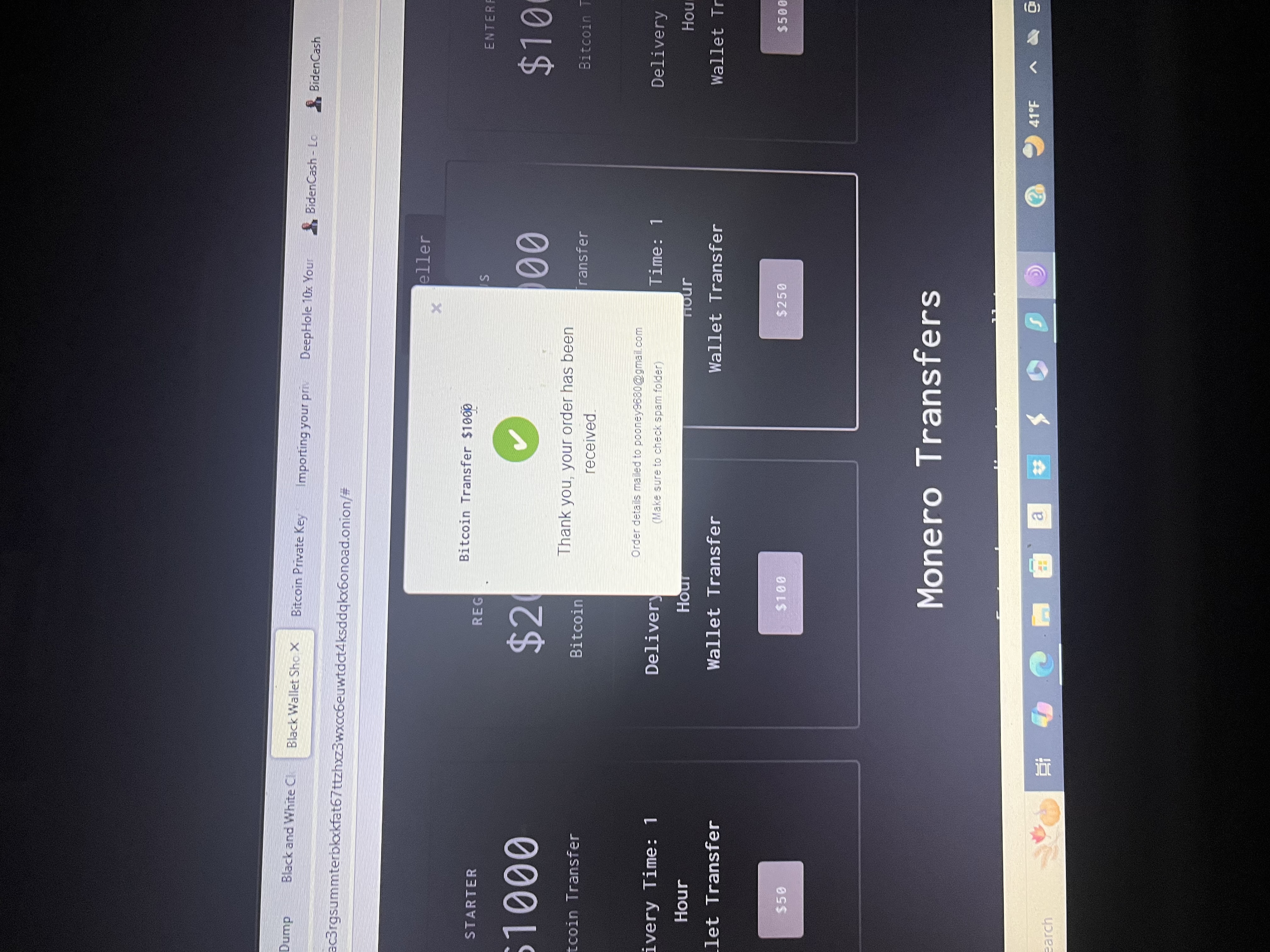

The original report outlines a case of clear financial fraud involving a cryptocurrency transaction. The complainant paid $50 USD in Bitcoin to a party who promised to provide $1000 USD worth of Bitcoin in return. Despite completing their payment, the complainant states that they never received the promised funds. This type of fraudulent scheme is common in online cryptocurrency spaces, where scammers exploit the irreversibility of Bitcoin transactions and the lack of regulatory oversight.

This scam operates on the premise of a disproportionate exchange offer—an implausible return that likely appealed to the complainant. The promise of a 1900% profit is a classic red flag associated with Ponzi schemes, phishing scams, and fraudulent exchanges. The lack of delivery after payment underscores the bad-faith intentions of the perpetrator, leaving the complainant with no recourse due to the anonymity and finality of Bitcoin transactions.

Photos :

Terminology and Terms Defined

To better understand the mechanics of this scam, the following terms require clarification:

- Bitcoin (BTC): A decentralized cryptocurrency that allows peer-to-peer transactions without intermediaries. While Bitcoin offers benefits like transparency and security, it also attracts fraudsters due to its anonymity and irreversibility.

- $50 USD (Bitcoin): The complainant converted $50 USD into Bitcoin for the transaction. The conversion process involves using cryptocurrency wallets or exchanges to transfer fiat money into digital currency.

- $1000 USD (Bitcoin): The promised payout in Bitcoin, significantly exceeding the input amount. Such disproportionate returns are a hallmark of scams, as legitimate exchange rates are always based on market value and do not offer such profits.

- Never Received Funds: This phrase indicates the scam’s completion. Once the complainant sent the Bitcoin, the fraudulent party ceased communication or failed to deliver the agreed-upon Bitcoin amount.

- Irreversible Transactions: Bitcoin transactions, once confirmed on the blockchain, cannot be reversed or canceled. This feature protects against fraud for merchants but leaves buyers vulnerable in scams.

Understanding these terms helps contextualize the report, highlighting the dynamics and vulnerabilities that allowed this scam to succeed.

Analysis and Recommendations

The complainant’s experience illustrates several critical lessons about recognizing and avoiding cryptocurrency scams. The promise of an implausibly high return on investment ($50 for $1000) was the bait used to attract the victim. Such offers prey on greed and a lack of familiarity with cryptocurrency market mechanisms. Once the payment was made, the scammer exploited the irreversibility of Bitcoin transactions to abscond with the funds.

To mitigate risks and prevent falling victim to similar scams, individuals should consider the following precautions:

- Evaluate Unrealistic Offers: Be wary of offers that promise unusually high returns, as they are almost always indicative of a scam. Legitimate exchanges or trades operate within standard market rates.

- Research the Counterparty: Verify the reputation and legitimacy of the party offering the exchange. Scammers often have no track record, fake profiles, or negative reviews.

- Utilize Trusted Platforms: Engage in cryptocurrency transactions only through well-established and regulated platforms. These platforms often include security measures like escrow services and identity verification.

- Educate Yourself on Cryptocurrency Mechanics: A better understanding of cryptocurrency transactions, including their risks and market behaviors, can help individuals identify red flags in potential scams.

The complainant’s report highlights the vulnerabilities in decentralized digital transactions, particularly when dealing with unknown parties. While the loss of $50 USD may be relatively small, the incident underscores the importance of vigilance and due diligence in cryptocurrency dealings. As digital currencies become increasingly prevalent, educating users about their risks and safeguards remains paramount.