Table of Contents

ToggleBlackMart and The Escrow – TOR Scam Report (131)

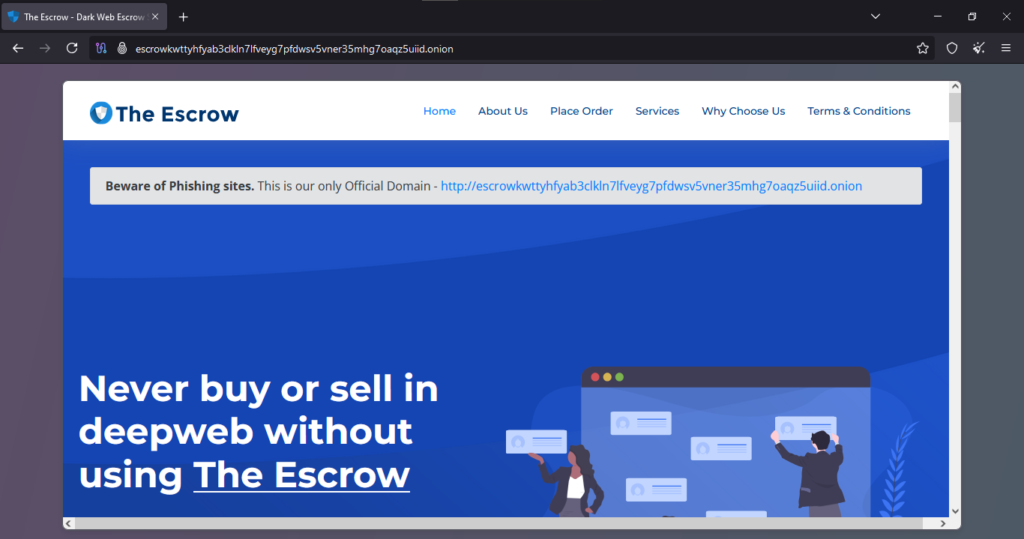

Onion Link : http://escrowkwttyhfyab3clkln7lfveyg7pfdwsv5vner35mhg7oaqz5uiid.onion/

Scam Report Date : 2025-01-25

Client Scam Report Breakdown

Original Scam Report :

The original scam report describes an incident where the client attempted to purchase a product using an escrow payment system. The client sent funds twice through the escrow system in hopes of receiving the product, but neither attempt elicited a response from the vendors involved. The lack of communication and failure to deliver highlights a deliberate misuse of escrow services to defraud buyers.

This scam is particularly harmful because escrow services are generally perceived as a secure method of conducting transactions, as they are meant to protect both buyers and sellers. By exploiting trust in the escrow system, the scammers not only defraud the client but also undermine the perceived reliability of the service itself.

2. Defining Terminology and Key Elements

To fully understand this case, it’s important to define key terms and concepts mentioned in the report:

- Escrow: A financial arrangement where a third party temporarily holds funds on behalf of two parties involved in a transaction until the terms of the agreement are met. Escrow is often used in high-risk transactions to ensure fairness and security.

- Non-Responsive Vendors: Vendors who fail to communicate or fulfill their obligations after receiving payment. This behavior is a clear indicator of fraudulent activity.

- Double Payment: The act of sending funds multiple times, often due to desperation or trust in the system, in an attempt to resolve an issue. Scammers may exploit this behavior by providing misleading assurances to prompt additional payments.

- Vendor Fraud in Escrow Systems: This occurs when scammers misuse escrow services by either faking their identity as the vendor or colluding with the platform to release funds without fulfilling the transaction.

The mention of escrow in this report suggests that the scammers leveraged its reputation as a secure system to mislead the victim. The absence of vendor responses after the client submitted payment points to either a complete breakdown of the escrow service’s integrity or fraudulent manipulation within the system.

3. Segment Analysis and Implications

This scam highlights a significant vulnerability in escrow-based transactions, where trust in the system can be exploited. Escrow is typically designed to act as a safeguard, ensuring that funds are not released to the seller until the buyer confirms receipt of the agreed-upon product or service. However, in this case, the vendors’ lack of responsiveness and the client’s inability to retrieve funds indicate either a failure of the escrow system to enforce its policies or intentional collusion between the scammers and the escrow provider.

The report also underscores the risks of making multiple payments in an attempt to resolve a dispute. By sending money twice, the client inadvertently increased their financial losses, potentially due to the scammers creating a sense of urgency or hope that the second payment might lead to resolution. This behavior is a common trap for victims who trust the system but are desperate to recover their transaction.

To mitigate such scams, buyers must exercise caution when using escrow services, particularly on unregulated platforms. Verifying the legitimacy of the escrow provider, understanding the terms of service, and researching vendor reputations are critical steps to avoid falling victim to similar schemes. Additionally, escrow platforms must improve their security protocols, ensure transparency in their processes, and provide accessible dispute resolution mechanisms to maintain user trust. Without these measures, escrow fraud could continue to erode confidence in an otherwise valuable transactional tool.