Table of Contents

ToggleCardshop – TOR Scam Report (1)

Onion Link: http://s57divisqlcjtsyutxjz2ww77vlbwpxgodtijcsrgsuts4js5hnxkhqd.onion

Scam Report Date: 2024/04/28

Client Scam Report Breakdown

Original Report Summary:

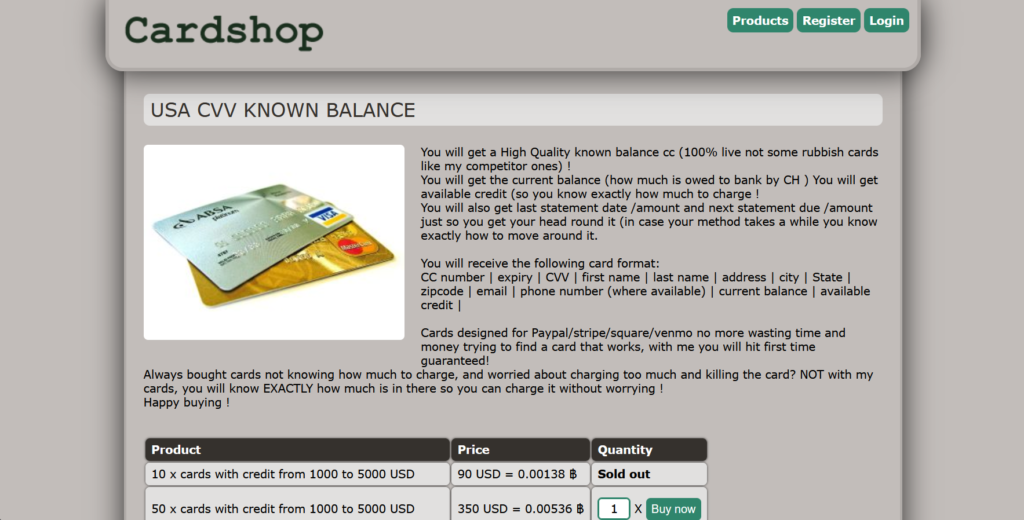

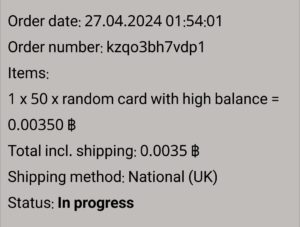

In this scam report, the user purchased a package valued at $350, containing purported high-quality USA CVV cards with known balances. The seller of these cards advertised them as “live,” which means the cards were allegedly active, with accurate and up-to-date information regarding both the current balance (the amount owed to the bank by the cardholder) and the available credit (the remaining amount that can be charged). The cards were marketed as specifically designed for use on platforms like PayPal, Stripe, Square, Venmo, and other similar payment processing systems, with claims of guaranteed success when charging these cards. This type of scam targets individuals attempting to use stolen or illicit credit card information for fraudulent purchases, often exploiting weaknesses in payment processors to circumvent detection.

Photos:

The original scam advertisement states that buyers would receive detailed card information, including the card number, expiration date, CVV (the card’s security code), the cardholder’s name, and address (if available). However, as noted in the report, many of these cards are “non-AVS,” meaning they do not require an address verification system match for transactions, allowing the user to input fake billing addresses when attempting to use the cards. The scam relies on enticing individuals who are concerned about the uncertainty of how much they can charge to a card, claiming that buyers will “know exactly how much is in there,” alleviating worries of overcharging and flagging the card. Despite these promises, the user who purchased the $350 package likely received non-functional or fraudulent cards, experiencing significant financial loss in the process.

Terminology and Scam Details

Breaking down the key terms, “CVV” refers to the Card Verification Value, a three-digit code found on the back of credit cards used to confirm that the card is physically present during transactions. The scam also references “AVS” (Address Verification System), a security feature that checks if the billing address provided during a transaction matches the address on file with the card issuer. “Non-AVS” cards, as mentioned in the scam, are cards that do not require this type of verification, making them more susceptible to fraud, as scammers can use fake addresses to bypass security checks. In this case, the seller falsely assures buyers that these cards will work effectively with various payment processors such as PayPal and Stripe.

The scam report highlights the critical flaw of these transactions: the card details provided are either completely fabricated or sourced from previously canceled or non-functional cards. The claim of having “fresh and high-quality CC & CVV” from various countries around the world is part of the deception, as the cards advertised are either invalid or do not possess the balance information as promised. The supposed “guarantee” that buyers will hit the card’s balance on the first try is a manipulation tactic designed to instill false confidence in the product. However, the $350 transaction likely left the buyer with nothing of value, demonstrating how such scams exploit people involved in illicit carding activities.

Analysis and Conclusion

This scam report reflects a common type of fraud in online black markets, where stolen or counterfeit card information is sold under the guise of being legitimate and functional. By promising known balances and functional card details that work on various platforms, the scam appeals to those involved in illegal carding operations, giving them a false sense of security when making fraudulent purchases. The reference to specific payment processors such as PayPal and Stripe further lures potential buyers who are looking for a quick and reliable method to exploit these systems. However, the reality is that the information provided in these packages is either incorrect or outdated, resulting in financial loss for the buyer.

In conclusion, this report showcases how scammers manipulate vulnerable or reckless buyers by offering guarantees that they cannot fulfill. The inclusion of detailed cardholder information and the promise of live cards with known balances are merely deceptive tactics to convince buyers that the product is worth their money. In this case, the buyer’s investment of $350 in a package of CVV cards did not result in any return, revealing the true nature of these scams and the ongoing threat they pose in underground markets. As with many scams in this space, the promise of “hitting first time guaranteed” is simply too good to be true.