Table of Contents

ToggleCardshop – TOR Scam Report (1)

Onion Link: http://s57divisqlcjtsyutxjz2ww77vlbwpxgodtijcsrgsuts4js5hnxkhqd.onion

Scam Report Date: 2023/01/25

Client Scam Report Breakdown

Original Report Summary:

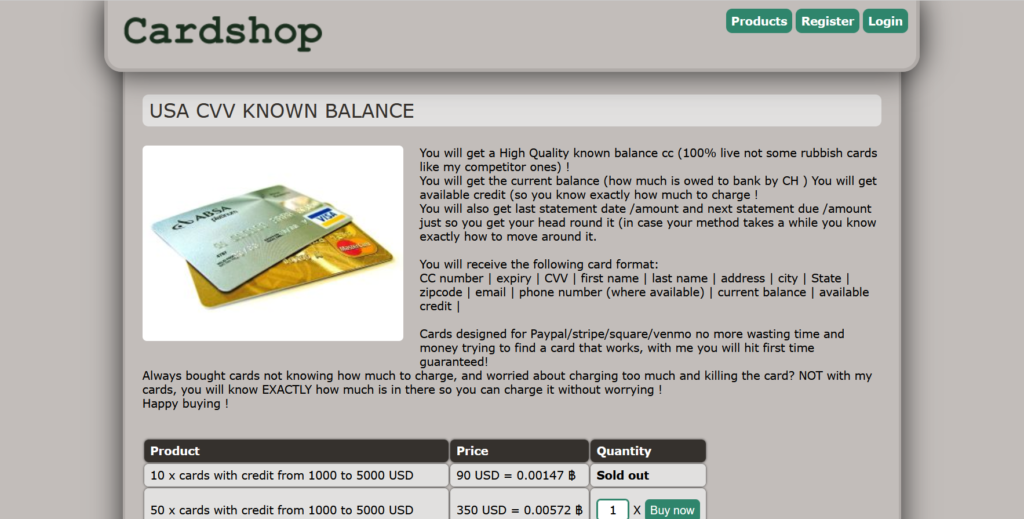

The “Scam” report outlines fraudulent activities involving Cardshop, an illicit marketplace selling compromised credit card details (CVV) with known balances, primarily targeting users seeking to exploit stolen financial data. The report begins with the platform’s enticing promises of high-quality, “100% live” credit cards from various countries, including the United States, United Kingdom, Germany, and Canada, among others. Cardshop advertises cards with known credit balances, claiming to provide users with detailed information such as current balance, available credit, last statement date, and next payment due, in order to facilitate fraudulent purchases on platforms like PayPal, Stripe, Venmo, and Square. However, this detailed sales pitch is a red flag, signaling that the platform is designed to cater to illegal activities, and likely scams its users through deceptive promises and unreliable products.

Photos:

To understand how the scam works, it is important to define several key terms used throughout the report. “CVV” refers to the Card Verification Value, a three- or four-digit number used to authenticate credit card transactions. In the context of Cardshop, the term is misleading, as the cards sold are unlikely to be legitimate or live, as claimed. The mention of “AVS” (Address Verification System) further highlights the scam’s technical setup, as many of the cards listed are “non-AVS,” meaning that they are not tied to a specific address, allowing scammers to use any billing address to attempt fraudulent transactions. Additionally, “BIN” (Bank Identification Number) refers to the first six digits of a credit card number that identify the issuing bank, which is a key detail buyers are allowed to choose when purchasing cards from Cardshop. This level of customization appeals to those looking to commit fraud, but the report suggests that buyers often end up with cards that do not work, despite the platform’s claims of guaranteed success.

The scam report also identifies key pricing schemes used to lure potential victims into larger purchases. For instance, the site advertises various price tiers for credit cards with balances ranging from $1,000 to $100,000. Buyers can purchase 10 cards with balances between $5,000 and $20,000 for $120, or up to 50 cards with balances from $20,000 to $50,000 for $650. The promise of high-balance cards at low prices is a common scam tactic, enticing users with the potential for quick profit. However, these cards are either stolen or fabricated, and buyers who fall for the scheme often find that the cards are rejected when used for transactions. The platform also pushes users toward bulk purchases by offering discounts on larger orders, such as 50 non-verified Visa cards with balances up to $100,000 for $800. The fact that most of these cards are “sold out” adds an air of exclusivity, making potential buyers feel pressured to purchase what is still available, another psychological tactic to increase sales before users realize they’ve been scammed.

Terminology and Scam Tactics

CVV (Card Verification Value): A security feature for card transactions that authenticates the user. Cardshop’s claim of selling “live” CVVs suggests the cards are stolen and ready for fraudulent use.

AVS (Address Verification System): A system that matches the billing address of the cardholder. “Non-AVS” cards sold on Cardshop allow users to enter fake billing addresses during fraudulent transactions.

BIN (Bank Identification Number): The first six digits of a card number that identify the issuing bank. Cardshop allows users to select specific BINs, adding an illusion of control over the fraud process.

The scam report reveals that Cardshop preys on the greed of users looking to exploit stolen credit card information while failing to deliver on its fraudulent promises. By offering various price points and geographical options (such as cards from specific countries or banks), the platform creates an illusion of legitimacy and choice, while in reality, it is scamming buyers who may never receive working card details. Even if a card were to function initially, the use of stolen credit card data is highly illegal, and any attempted transactions would ultimately result in cancellation, chargebacks, or legal repercussions for the user. Furthermore, Cardshop operates using Bitcoin, a cryptocurrency known for its anonymity and irreversibility, making it impossible for buyers to recover their funds once the scam is discovered.

In conclusion, the scam report highlights how Cardshop exploits the dark web marketplace’s typical lack of oversight, providing a façade of guaranteed success while scamming users out of their money. The use of technical jargon, such as “non-AVS” and “BIN,” along with bulk purchase discounts, serves as bait to attract unsuspecting buyers, who are then left with unusable card details and no recourse for reclaiming their money. This report emphasizes the importance of understanding the terminology and tactics used by fraudulent platforms to protect oneself from falling victim to such scams.