Table of Contents

Togglecaribbean card – TOR Scam Report (1)

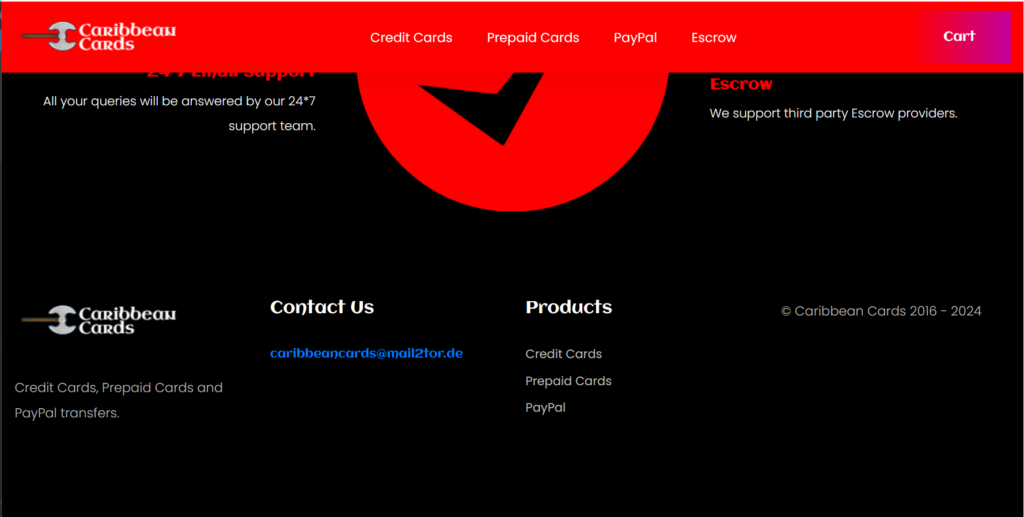

Onion Link: http://caribcc5jik7maeqfit7h34af7ntatggbmlfhyxjnqnrhij7gjt5vtid.onion

Scam Report Date: 2024/08/27

Client Scam Report Breakdown

Original Report Summary:

This report examines a scam report submitted by a client regarding an alleged fraudulent transaction with “Caribbean Cards,” a vendor operating on the dark web. The client reported attempting to purchase a prepaid card through the vendor’s platform, making a payment of $78 on August 17th via an escrow service referred to as “ESCREW.” Following the initial transaction, the vendor claimed that the prepaid card was unavailable, prompting the client to add an additional $30 via ESCREW. Furthermore, the client states they also sent an additional direct payment of $60 to the vendor, presumably to expedite the transaction. Despite these payments, the client has not received the purchased prepaid card or any response from the vendor through email correspondence.

Transaction Details and Client Interaction

The client began the transaction by paying $78 via ESCREW on August 17th, trusting that this would offer some form of security during the payment process. ESCREW is a term used within the dark web to describe third-party escrow services designed to hold funds securely until the buyer confirms receipt of the purchased goods. These services are especially popular on the dark web, where vendors often lack legitimacy, and transactions carry a heightened risk of fraud. Caribbean Cards’ advertisement of escrow support likely contributed to the client’s initial sense of security. However, the vendor later cited an “unavailable” status for the prepaid card, urging the client to add another $30 via ESCREW. Despite the client’s compliance with these demands, the vendor requested further payment directly, which the client met by sending $60 without escrow protection.

After these interactions and payments, the client attempted to contact Caribbean Cards for updates or confirmation of their order. Unfortunately, neither the vendor nor any affiliated party responded to the client’s emails, leaving them without the prepaid card they purchased or a refund. Such behavior strongly indicates fraudulent activity on the vendor’s part, as legitimate sellers are expected to maintain clear communication with buyers and uphold the terms advertised.

Analysis of Fraud Indicators

This case illustrates several indicators of fraudulent behavior common among dark web vendors. The initial solicitation for additional payments after the primary transaction is a red flag, as reputable vendors typically finalize terms upfront. Moreover, the vendor’s insistence on a direct payment outside of ESCREW is particularly suspicious. Requiring off-escrow payments negates the buyer’s protection and is often a tactic used by scammers to retain funds without fulfilling orders. Finally, the lack of communication post-payment, despite claims of “24/7 Email Support” and “Worldwide Shipping” on the Caribbean Cards website, reflects untrustworthiness. This scam report highlights the risks inherent in transactions with unverified vendors on dark web marketplaces, underscoring the importance of buyer awareness and reliance on trustworthy escrow services.

Glossary of Terms

Dark Web: A part of the internet accessible only via specialized software (e.g., Tor), often used for anonymous communication and transactions. It hosts various marketplaces that may sell illicit or unregulated goods.

Prepaid Card: A payment card with a predetermined balance that can be used for online and in-person transactions, similar to a debit card but without a direct connection to a bank account.

ESCREW: An escrow service that temporarily holds funds during a transaction until the buyer confirms receipt of the purchased item, acting as a safeguard against fraudulent vendors.

24/7 Support: A customer service claim indicating round-the-clock availability. In this case, it is likely part of the vendor’s deceptive marketing.

Conclusion

The fraudulent transaction reported with Caribbean Cards exemplifies common scam tactics on dark web marketplaces, where vendors use escrow, additional payment demands, and direct payment requests to exploit buyers. The client’s experience emphasizes the importance of due diligence when engaging with online vendors, especially in unregulated environments where consumer protections are minimal. This report serves as a cautionary case study for potential buyers on dark web marketplaces, reinforcing the need for thorough vendor research and caution when requested to deviate from protected payment methods.