Table of Contents

ToggleccPal – TOR Scam Report (5)

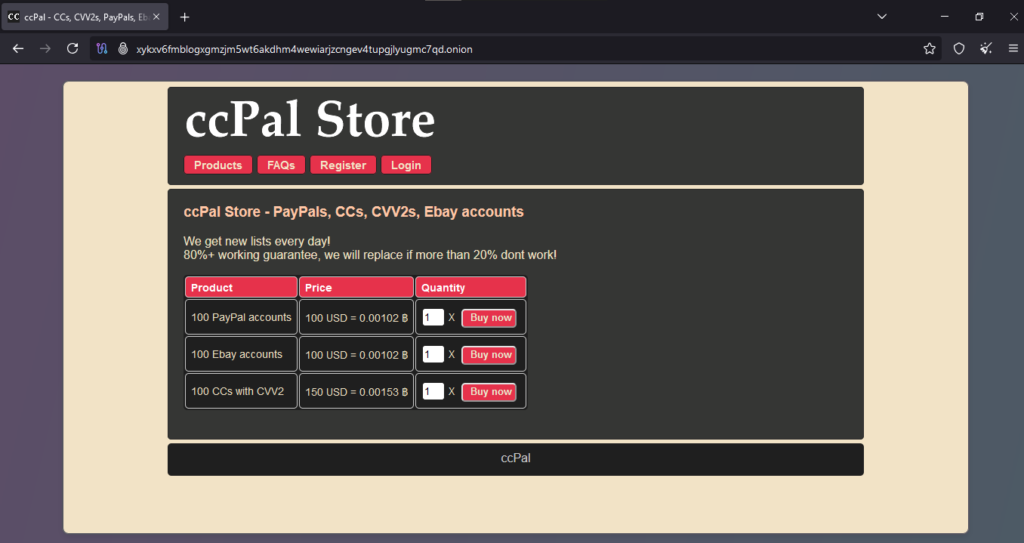

Onion Link : http://xykxv6fmblogxgmzjm5wt6akdhm4wewiarjzcngev4tupgjlyugmc7qd.onion

Scam Report Date : 2024-12-11

Client Scam Report Breakdown

Original Scam Report :

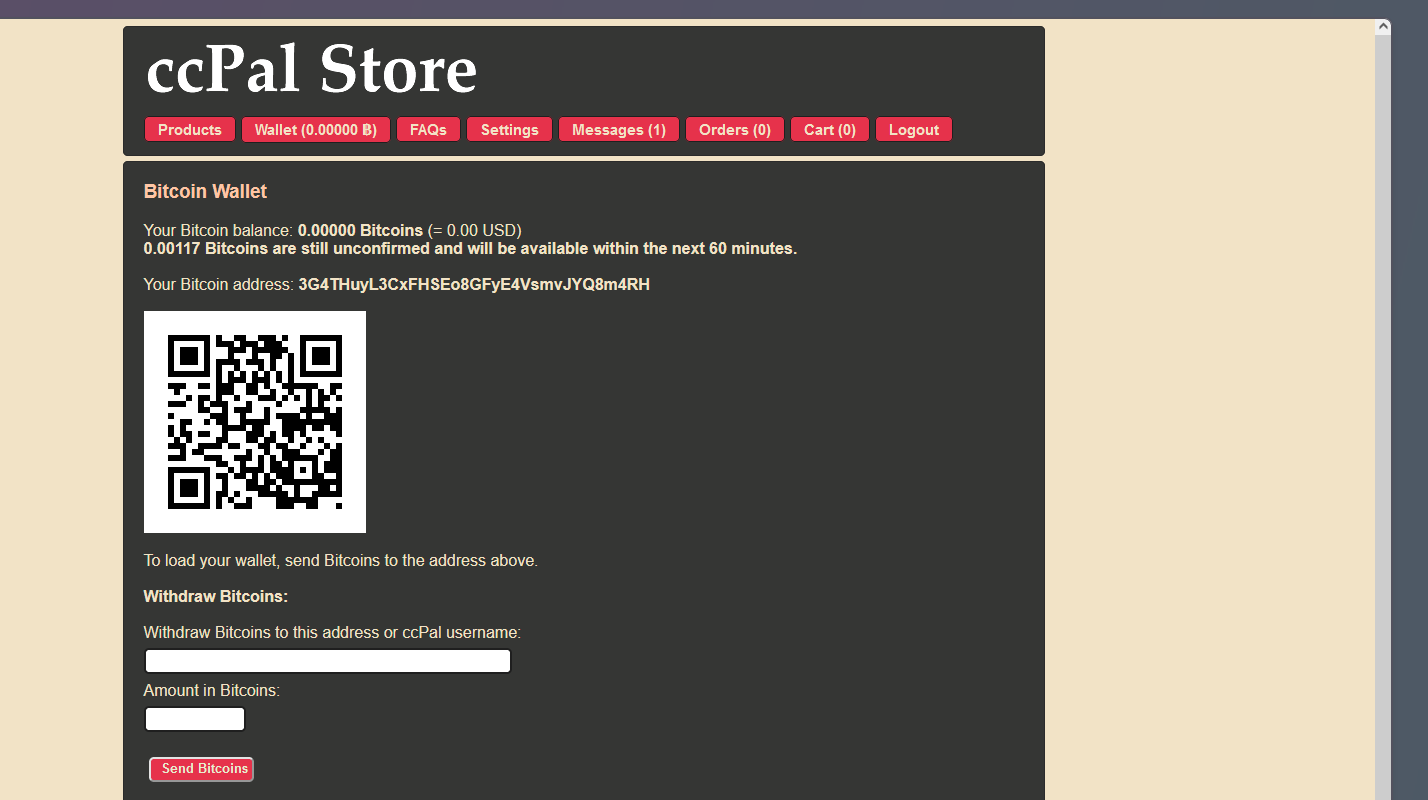

The original report is concise, stating: “got the btc shows on blockchain.” This suggests the client sent Bitcoin (BTC), which was confirmed on the blockchain, but they encountered an issue afterward. The brevity of the report implies frustration or urgency in seeking resolution. The mention of Bitcoin being “on the blockchain” indicates the transaction was successfully processed and recorded. However, this detail hints at a possible scam involving the recipient not fulfilling their part of the agreement after the funds were transferred. Such behavior is typical in fraudulent schemes involving cryptocurrency transactions, where scammers rely on the irreversible nature of blockchain transfers to evade accountability.

Photos :

2. Defining Terminology and Scam Mechanics

To fully comprehend the report, it is essential to define key terms. BTC, or Bitcoin, is a decentralized digital currency based on blockchain technology. It operates on a peer-to-peer network without the need for intermediaries, making it both a convenient and risky medium for transactions. The blockchain is a public ledger that records all cryptocurrency transactions in a decentralized, transparent, and immutable manner. When a user sends BTC, the transaction is validated and permanently added to the blockchain, creating a record accessible to anyone with the transaction ID.

The phrase “shows on blockchain” confirms that the client’s transaction was completed successfully from their end, meaning the funds were sent and verified by the network. However, this does not guarantee the recipient’s cooperation. Scams involving blockchain often exploit the irreversible nature of transactions; once BTC is sent, it cannot be retrieved without the recipient’s consent. This is why fraudsters frequently target cryptocurrency users, knowing that victims have limited recourse for recovery. In such scams, the recipient may falsely claim they never received the funds or cease communication entirely, leveraging the anonymity provided by cryptocurrencies.

3. Analysis and Recommended Actions

The scam described highlights the inherent risks of cryptocurrency transactions, particularly in unregulated or informal exchanges. For clients, verifying the recipient’s trustworthiness before sending funds is paramount. This can include checking for a verified reputation on the platform being used, requesting escrow services, or conducting smaller test transactions to build trust. It is also important to use trusted third-party platforms or wallets with built-in dispute resolution mechanisms for higher-value transactions.

For cases where fraud has occurred, victims should document every detail, including the transaction ID, the recipient’s wallet address, and any communication history. The blockchain’s transparency can aid in identifying where the funds were sent, though tracking the recipient’s real-world identity often requires professional assistance from cybersecurity experts or law enforcement. Additionally, users should report scams to platforms that monitor cryptocurrency fraud, such as Chainalysis or CipherTrace, which may help flag suspicious wallets and prevent further incidents.

This report underscores the importance of education and caution when dealing with cryptocurrency. Users must understand both the advantages and risks associated with blockchain technology, including its lack of reversibility and pseudonymous nature. By promoting awareness of these issues and taking proactive steps to secure transactions, clients can minimize their vulnerability to scams in the future.