Table of Contents

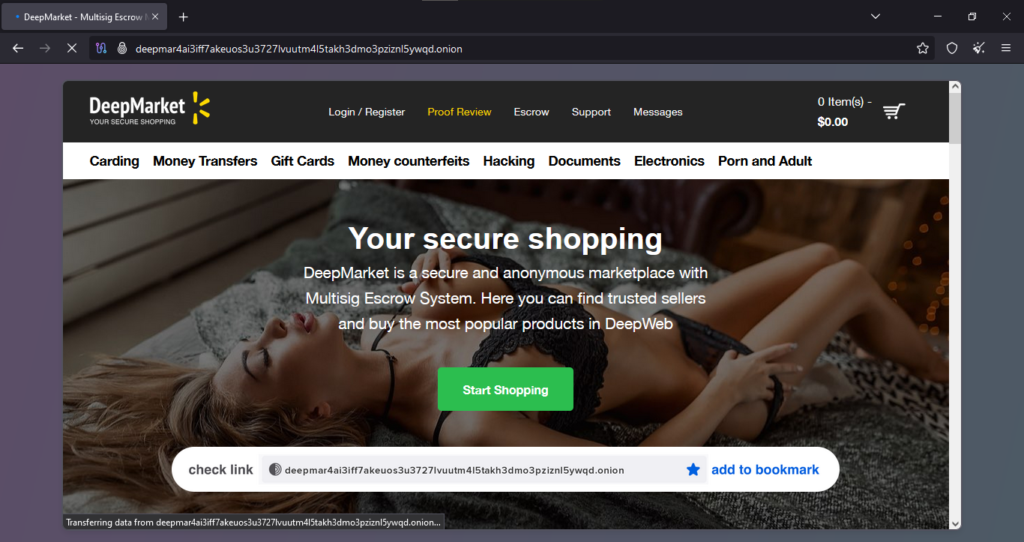

ToggleDEEP MARKET – TOR Scam Report (153)

Onion Link : http://deepmar4ai3iff7akeuos3u3727lvuutm4l5takh3dmo3pziznl5ywqd.onion

Scam Report Date : 2025-02-03

Client Scam Report Breakdown

Original Scam Report :

The client reported a fraudulent transaction that took place on January 11, 2025, involving a PayPal purchase on an online marketplace. According to the client, they never received the product after making the payment. When attempting to resolve the issue through the platform’s escrow system, the client received no communication from the marketplace or the seller. The client ultimately concluded that the transaction was a scam, as no resolution was provided, and they were unable to recover their funds. This report highlights a common type of fraud where scammers exploit payment systems and marketplace escrow features to deceive buyers.

2. Defining Key Terminology and Terms

To better understand the nature of this scam, it is important to define several key terms mentioned in the report. PayPal purchase refers to a financial transaction conducted via PayPal, a widely used online payment system that offers buyer protection policies. However, PayPal’s buyer protection is often limited for digital goods or purchases made through unverified sellers, making it a common target for fraudsters. The term escrow refers to a financial arrangement where a third party holds funds until the buyer confirms receipt of goods or services. Legitimate escrow systems are designed to protect both buyers and sellers, but in fraudulent marketplaces, escrow services can be manipulated or entirely fake, leaving buyers without recourse. Finally, the phrase “just scams” in the original report suggests the client believes the entire marketplace or seller is engaging in fraudulent activity, possibly as part of a larger scheme targeting unsuspecting buyers.

3. Analysis of the Scam and Its Implications

This case appears to fall into the category of marketplace escrow fraud, a tactic commonly used in deep web and illicit marketplaces. The lack of communication from the escrow system suggests that either the marketplace itself is complicit in the scam or the seller exploited a loophole in the system to avoid accountability. This tactic is frequently used in gray-market transactions, where products or services fall outside of regulated commerce, making it difficult for buyers to dispute transactions. Since the client never received the product and the escrow service failed to respond, it is likely that the funds were either immediately transferred out of escrow or the escrow system itself was a front for a scam. Without external buyer protection measures, such as third-party arbitration or a verifiable reputation system, users on these marketplaces are at a high risk of fraud. This report reinforces the importance of conducting due diligence before making purchases on unverified platforms, as well as using secure payment methods with robust dispute resolution options.