Table of Contents

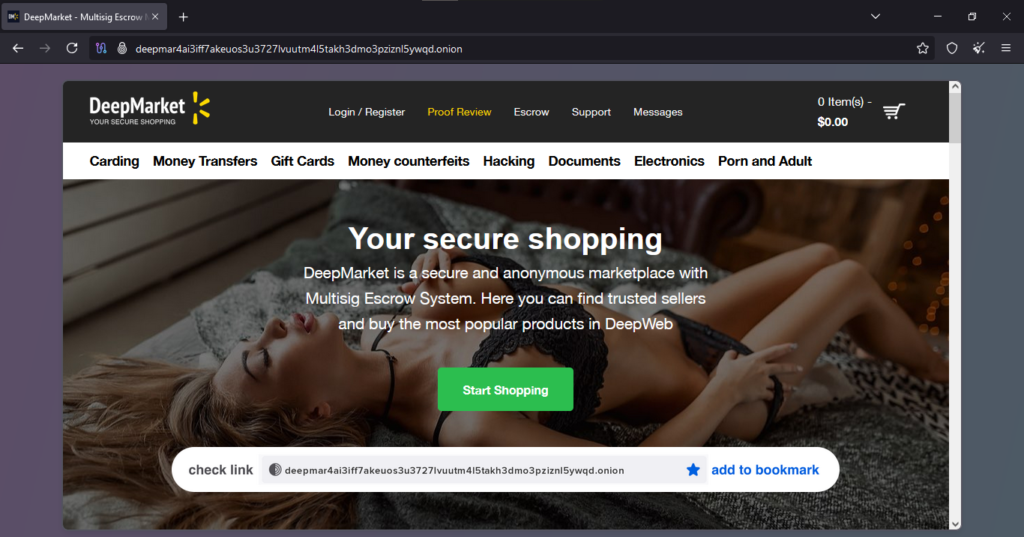

ToggleDeep Market – TOR Scam Report (155)

Onion Link : http://deepmar4ai3iff7akeuos3u3727lvuutm4l5takh3dmo3pziznl5ywqd.onion

Scam Report Date : 2025-02-03

Client Scam Report Breakdown

Original Scam Report :

The client reported an issue where they never received the product they had paid for and attempted to contact the escrow service, but received no communication in response. Based on this experience, they concluded that the platform was “just scams”, indicating that they believe the entire marketplace operates fraudulently. The absence of communication from the escrow service is a major red flag, as escrow systems are designed to act as an intermediary to ensure fair and secure transactions. When escrow services fail to respond or intervene in a dispute, it often suggests intentional fraud rather than a simple oversight. The lack of product delivery, coupled with the unresponsive escrow, suggests that the marketplace itself may be complicit in the scam rather than just a case of an individual seller acting dishonestly.

2. Defining Key Terminology and Terms

To fully grasp the implications of this report, it is important to define key terms mentioned by the client. Escrow is a financial arrangement where a third party temporarily holds funds until a buyer confirms they have received their order. In legitimate transactions, escrow protects buyers by preventing sellers from receiving funds until the product is delivered. However, fraudulent marketplaces often fake their escrow services, leading buyers to believe their funds are protected when, in reality, the money is immediately taken by the scam operators. The term “no communication” is also crucial, as legitimate marketplaces and escrow services should have responsive customer support to address disputes. When a platform fails to reply, it often indicates deliberate avoidance, suggesting the business model itself is designed to steal funds rather than facilitate real transactions. Lastly, the phrase “just scams” signifies the client’s overall assessment that this is not an isolated incident, but rather a systematic deception targeting multiple buyers. This aligns with known scam tactics where fraudulent marketplaces lure in victims with promises of security, only to disappear or ignore complaints after receiving payments.

3. Analysis of the Scam and Its Implications

This case is an example of escrow fraud, a common scheme in darknet and unregulated marketplaces where users are led to believe their money is protected when it is not. The scam follows a predictable pattern: a buyer makes a purchase, the escrow system appears to hold the funds, but when an issue arises, the platform refuses to communicate or release the money. This suggests that the escrow system is not a true third-party service, but rather an integrated scam where the funds are directly controlled by the fraudulent marketplace operators. The lack of product delivery indicates that the scam is not just an isolated case of a dishonest seller, but potentially an entire fraudulent marketplace operation. Buyers who fall victim to these scams often have no legal recourse, especially if cryptocurrency transactions were used, as they are irreversible. This case highlights the importance of thoroughly researching marketplaces, verifying their escrow legitimacy, and being cautious of any platform that lacks a verifiable dispute resolution process. Ultimately, the client’s report serves as a warning to others that some marketplaces use the illusion of escrow protection to steal funds rather than to facilitate legitimate transactions.