Table of Contents

ToggleDeep Market – TOR Scam Report (1)

Onion Link: http://deepmarcxr3lklyjejuxkfe65exx54srsfay36zmpubutrmjqdo4w3qd.onion

Scam Report Date: 2023/10/22

Client Scam Report Breakdown

Original Report Summary:

The client’s complaint stems from a fraudulent PayPal transfer transaction, where they purchased a promised PayPal fund transfer for $59, expecting to receive $750 in return. In the original report, the client highlights their disappointment and frustration, labeling the transaction as a “SCAM.” This type of scam is commonly known as a “PayPal flip scam” or a “cash-flipping scam.” In such schemes, scammers advertise an opportunity to multiply a small payment into a larger sum. The victim sends a payment, and in return, the scammer promises a larger payout. However, as demonstrated in this case, the payout never materializes.

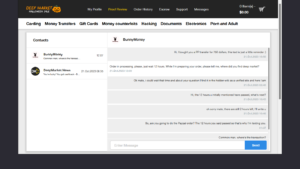

Photos:

The transaction itself raises red flags in terms of unrealistic profit margins. Scams offering impossibly high returns, like $59 turning into $750, rely on the psychology of quick and easy money to bait victims. The client’s report mentions, “they promised,” indicating that verbal or text-based communication was used to entice them into the fraudulent deal. In such scams, perpetrators often create a sense of urgency or exclusivity to persuade the victim to act quickly before they have time to reconsider or investigate the legitimacy of the offer. The use of platforms like PayPal is also significant because they are well-known and trusted, which scammers exploit to lend credibility to their fraudulent schemes.

Breakdown of the Fraudulent Process

In this report, we observe a common structure in how this scam operates. First, the client is drawn in by an advertisement or communication promising a substantial financial return in exchange for a small upfront payment. In this case, the client paid $59 in exchange for a promise of $750. This process aligns with the behavior of what is known as “advance-fee fraud.” In advance-fee fraud, a scammer asks for an upfront payment with the false promise of a larger future payout. Terms like “transfer” are commonly used to give the illusion of a financial transaction, but they are merely tools for deception.

Once the payment is made, the scammer disappears, or in some cases, they might offer additional excuses for why the payout has been delayed. The client here does not provide any specific follow-up interactions with the scammer but definitively concludes that they did not receive the promised $750. It’s also important to note that this scam likely involved communication through encrypted or anonymous platforms, making it difficult for the client to trace the scammer or recover their funds. Given that no legitimate financial institutions or services offer returns this significant for such a minimal investment, the red flags in this scam are obvious in hindsight. However, at the moment of interaction, scammers are skilled at deflecting suspicion and securing the victim’s trust.

Defining Key Terminology and Conclusion

Several terms within this scam report require precise definitions to better understand how these scams work. The term PayPal transfer refers to a process where funds are moved from one PayPal account to another. In legitimate scenarios, this can involve payments between friends, businesses, or services. In this scam, however, the term is misused to falsely imply a legal transaction. Cash-flipping is a term commonly associated with fraudulent schemes that promise to multiply an initial investment in an unreasonably short period. The word scam in this report is used by the client to denote the fraudulent nature of the interaction, describing a deceptive act intended to swindle money from victims. Advance-fee fraud, a broader category under which this scam falls, refers to any scheme where a victim pays money upfront with the expectation of receiving something of higher value later.

In conclusion, the scam in question is a classic example of an advance-fee fraud involving unrealistic promises of easy profits. The client, lured by the possibility of turning $59 into $750, was unfortunately deceived. This report highlights how common terms like “PayPal transfer” can be exploited in fraudulent contexts, and it underscores the need for vigilance when encountering offers that seem too good to be true. With growing sophistication in scam techniques, it is crucial for individuals to remain cautious and skeptical, especially when dealing with financial transactions on platforms that scammers may misuse for illicit purposes.