Table of Contents

ToggleDeepMarket – TOR Scam Report (59)

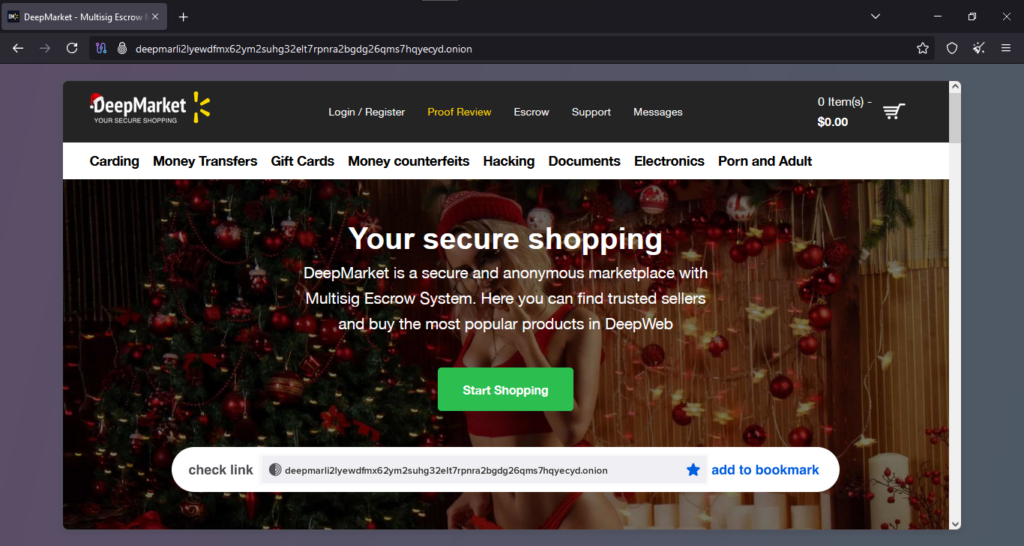

Onion Link : http://deepmarli2lyewdfmx62ym2suhg32elt7rpnra2bgdg26qms7hqyecyd.onion/

Scam Report Date : 2025-01-02

Client Scam Report Breakdown

Original Scam Report :

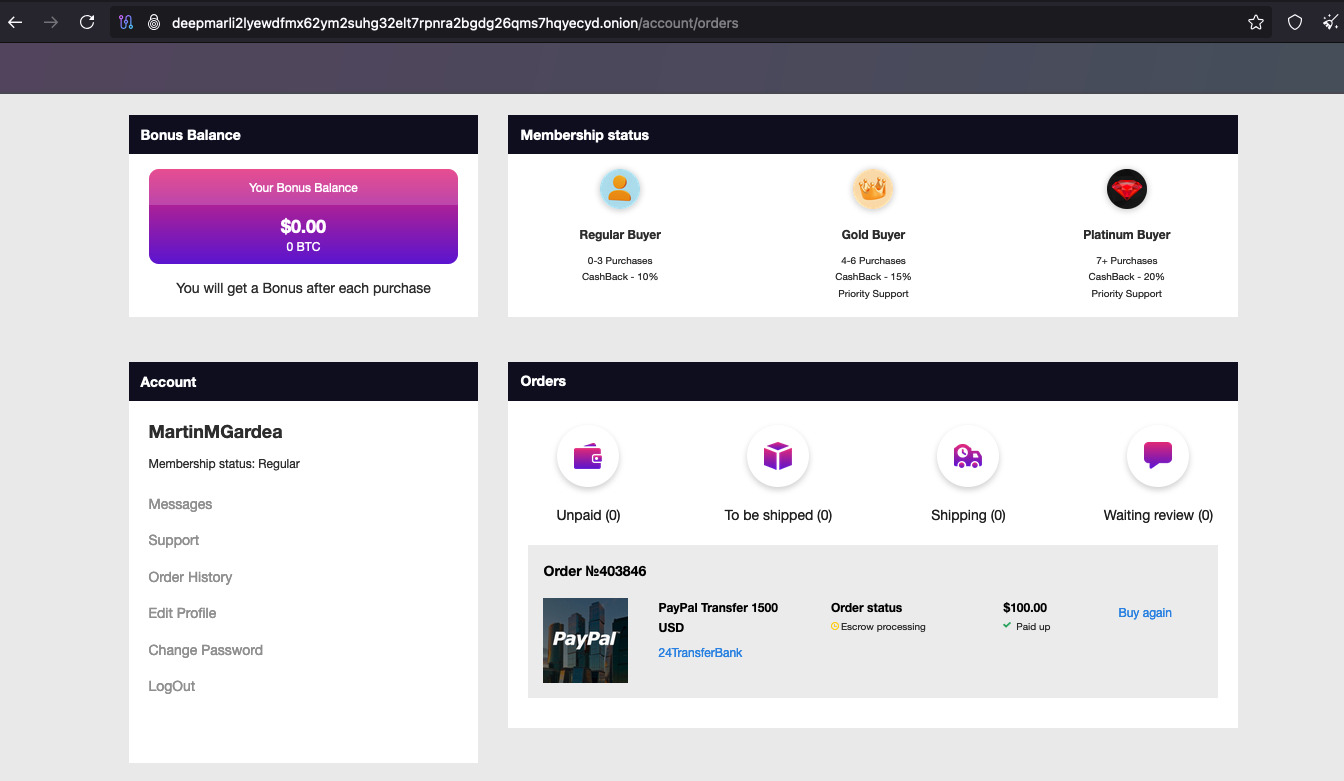

According to the client’s original report, they were scammed for a PayPal money transfer product. This type of scam typically involves fraudulent parties promising money transfers via PayPal in exchange for upfront payments or other transactions. In this case, the client likely expected a legitimate financial service but fell victim to deceptive practices. The original report lacks specific details, such as the scammer’s methods, communication channels, or the promised product’s nature. However, these elements are critical for understanding the modus operandi of the scammer and providing actionable insights.

Photos :

2. Defining Key Terms and Processes

To better contextualize this report, it is essential to define the relevant terminology. “PayPal money transfer product” generally refers to services offered through the PayPal platform, enabling users to send and receive funds. Scams involving PayPal may exploit its platform’s trustworthiness, targeting individuals unfamiliar with its security features, such as buyer protection and dispute resolution. Key terms include:

- Fraudulent Transaction: An unauthorized or deceptive financial activity intended to exploit the victim.

- Upfront Payment Scam: A fraudulent scheme in which victims are asked to pay in advance for goods or services they never receive.

- Social Engineering: A tactic used by scammers to manipulate individuals into divulging sensitive information or making decisions against their best interests.

Understanding these terms helps identify the scam’s mechanics and potential preventive measures. The absence of specific scam details in the report also highlights the need for thorough documentation to aid investigation and resolution.

3. Recommendations and Prevention Strategies

Given the client’s experience, preventing similar scams involves adopting robust safety practices. Users should only conduct transactions within PayPal’s official ecosystem, avoiding third-party promises of services or benefits. Familiarizing oneself with PayPal’s security features—like account monitoring, two-factor authentication, and the resolution center—is crucial. Reporting suspicious activities promptly to PayPal and local authorities ensures that such scams are tracked and mitigated.

Moreover, education on recognizing warning signs—such as requests for upfront payments, pressure to act quickly, or communication through unofficial channels—is vital. Empowering users with knowledge about scams helps reduce vulnerabilities. Future reports should include detailed accounts of the scam, including dates, amounts, communications, and any evidence (e.g., screenshots) to strengthen investigative efforts and hold scammers accountable.

This breakdown aims to clarify the nature of the reported scam, define essential terms, and provide actionable recommendations for safeguarding against similar fraudulent activities.