Table of Contents

TogglePremium cards – TOR Scam Report (8)

Onion Link: http://hbl6udan73w7qbjdey6chsu5gq5ehrfqbb73jq726kj3khnev2yarlid.onion

Scam Report Date: 2024/01/03

Client Scam Report Breakdown

Original Report Summary:

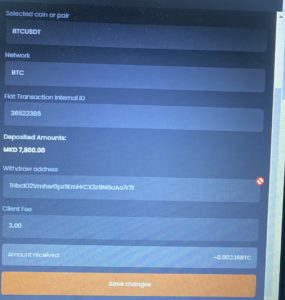

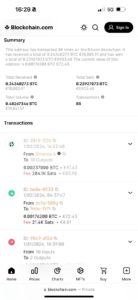

A customer, as indicated in the original report, encountered a fraudulent operation involving Premium Cards. The individual ordered a prepaid Euro Visa card, advertised with a balance of $2,000, and paid a total of $138, inclusive of a $110 card fee and an additional $28 Bitcoin network fee. This report highlights the customer’s loss and the unresponsiveness of Premium Cards to their inquiries. Despite the high costs associated with the transaction, the customer did not receive the promised product and was unable to establish further communication with the company. This scam underscores the importance of verifying the legitimacy of online services offering financial products, especially those operating in the gray area of the dark web.

Photos:

To understand the intricacies of this scam, it is essential to define some of the terms used. A prepaid Euro Visa card, as described in the scam, is a type of card that is preloaded with a specific amount of money—in this case, $2,000. These cards are often marketed as convenient and secure ways to carry money, particularly for travelers, as they can be used like a regular debit card for purchases and ATM withdrawals. However, in the context of this scam, the prepaid card was never delivered, and the customer was left without the funds they had expected to access.

Bitcoin, which was used for the transaction, is a decentralized digital currency without a central bank or single administrator. It can be sent from user to user on the peer-to-peer Bitcoin network without the need for intermediaries. The report mentions a network fee of $28, which is a common occurrence when transferring Bitcoin; this fee compensates miners for processing and securing transactions on the blockchain. The customer’s use of Bitcoin adds an additional layer of risk to the transaction because cryptocurrency transactions are irreversible, making it difficult to recover funds if something goes wrong, as in this case.

The case reported by the customer demonstrates the high level of risk associated with engaging with unverified online services, especially those that promise unrealistic financial benefits. The customer initially found Premium Cards through a service that claims to offer “cleaned” funds on prepaid debit cards, designed to be untraceable and unblockable. These services often target individuals looking to access funds without leaving a digital footprint, appealing to those seeking privacy or involved in illicit activities. However, these services are ripe for scams, as the operators can easily disappear after receiving payment, leaving victims with no recourse.

Premium Cards, which the report alleges to be a scam, has been in operation since 2012, according to the information on their site. They market themselves as a reliable provider of prepaid cards, boasting a client base of over 20,000 satisfied customers. However, as evidenced by the scam report, these claims are likely fabricated to lure unsuspecting customers into making payments for products they will never receive. The company’s silence after receiving payment is a classic tactic used by scammers to avoid detection and accountability. The customer’s attempt to contact Premium Cards after their purchase went unanswered, which is a common red flag in online scams.

In conclusion, this report serves as a cautionary tale about the dangers of engaging with online services that promise financial products or services, particularly those involving cryptocurrencies. The anonymity and irreversibility of Bitcoin transactions make it a preferred payment method for scammers, as victims have little to no recourse once their money is gone. The customer’s loss of $138 is a stark reminder of the risks involved in seeking out such services without thoroughly verifying their legitimacy. It is crucial for consumers to conduct extensive research, seek out reputable reviews, and be wary of deals that seem too good to be true, especially when dealing with financial products in the digital and dark web marketplaces.