Table of Contents

Togglequick vendor- TOR Scam Report (1)

Onion Link: http://zakqeikezkobypkpt2uuyexwazffcmrfsr5dzk6mtwdf26h5f5qd5mid.onion

Scam Report Date: 2023/10/16

Client Scam Report Breakdown

Original Report Summary:

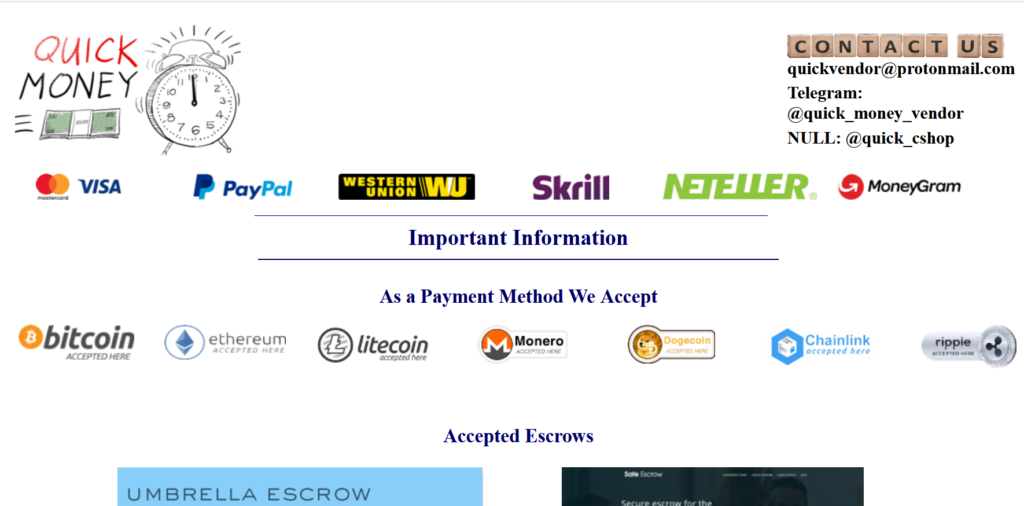

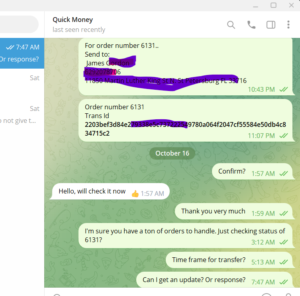

In this report, the client details their experience with an online “transfer and carding site,” which advertised quick money transfers using fraudulent means. According to the client, they followed the instructions provided on the site, which typically involve sending funds to a third party, usually for the purpose of receiving a larger sum of money later. The site initially claimed that once the payment was made, the client would receive an MTCN (Money Transfer Control Number) within 2-3 hours. However, the client reports that after sending the funds and waiting four hours, they only received one brief response on Telegram from the site’s support team. The support response indicated that they would “check” on the transfer, but no further updates were provided. After 12 hours had passed with no communication or transfer confirmation, the client became suspicious and requested assistance, attaching screenshots of the payment confirmation and communication logs as supporting evidence.

Photos:

This initial segment of the report highlights several important details that are key to understanding the potential scam. A carding site typically refers to an illegal marketplace where stolen credit card information is bought and sold. In this context, the mention of a “transfer and carding site” suggests that the site was offering illicit services, possibly connected to the use of stolen financial information to execute the transfer. Additionally, the term MTCN is a unique code issued by services like Western Union for tracking wire transfers. This code is essential for the recipient to claim the funds, and the failure to receive it after the promised time frame is a red flag indicating possible fraud. Telegram, a popular messaging platform, was used for communication in this case, but its widespread use in deep web transactions often presents challenges for fraud resolution due to its privacy-focused features, like encrypted messages and read receipts without sender accountability.

Scam Red Flags and Communication Breakdown

A key issue identified in the report is the communication breakdown between the client and the support team. After the client completed the transfer, they expected the MTCN to be sent within the stated 2-3 hours. However, after receiving just one vague response on Telegram (“we will check”), the client was left waiting without further updates for over 12 hours. The delay and lack of transparency are common indicators of scam behavior, especially in the realm of deep web marketplaces, where service providers can easily disappear after receiving payment. While the client expressed a willingness to wait longer if necessary, their main concern was the absence of any communication from the service provider, which exacerbated their frustration and suspicion. The screenshots provided, including those of the payment confirmation and the unanswered Telegram messages, strengthen the claim that the service provider was intentionally avoiding the client after receiving payment.

The terminology used here is worth clarifying. Telegram’s “seen” feature, for instance, shows that a message has been delivered and opened, but it offers no further accountability as to why the recipient has not responded. This feature, while useful for legitimate transactions, can be exploited by scammers to falsely reassure the client that they are still being acknowledged, even if the scammer has no intention of following through. The client’s concern regarding the lack of communication after the initial contact is also common in scams where the service provider uses minimal engagement to appear legitimate, buying time to take more victims.

Scam Evidence and Potential Resolution

In the final part of the report, the client attached crucial pieces of evidence, including screenshots of the site’s payment confirmation and communication logs from both email and Telegram. These attachments are key to verifying the client’s claims and potentially initiating further investigation. While the client doesn’t mention the exact amount of money transferred, the implication is that it was significant enough to cause alarm when the service provider failed to deliver the MTCN as promised. Based on the evidence presented, the lack of any real follow-up communication, combined with the vague response received, suggests that the site was fraudulent, and the client has likely fallen victim to a scam.

In terms of resolution, the client may attempt to dispute the transaction if they used a payment method that allows chargebacks. However, many transfer and carding sites require payment in cryptocurrency, which is difficult to recover due to its decentralized nature. Chargeback mechanisms, where available, are often a last resort for victims of scams, allowing them to recover funds by proving that no service was rendered. Without more direct forms of resolution, the best course of action for future transactions would involve avoiding suspicious sites altogether, especially those offering illicit services like carding and fraud-based transfers.