Table of Contents

ToggleTorBay – TOR Scam Report (15)

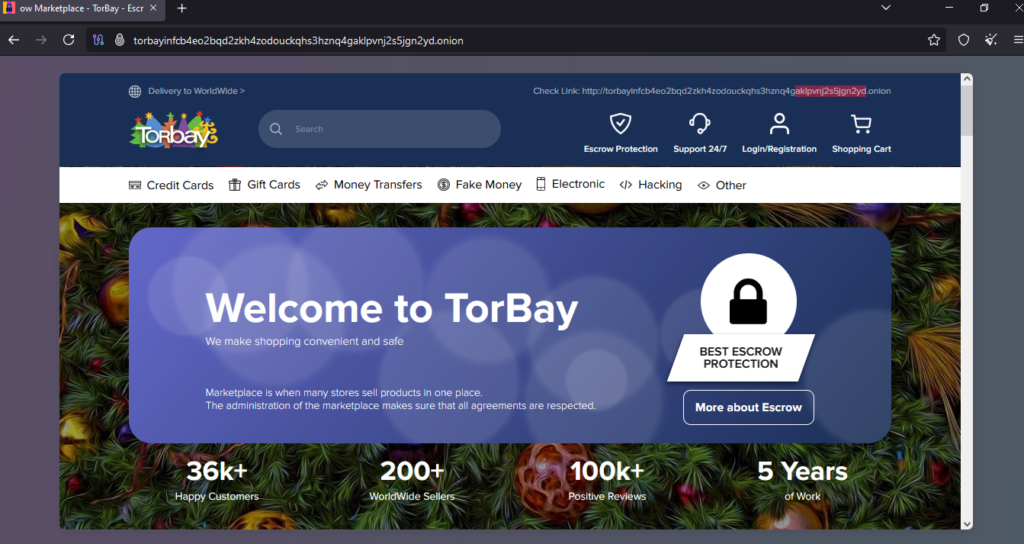

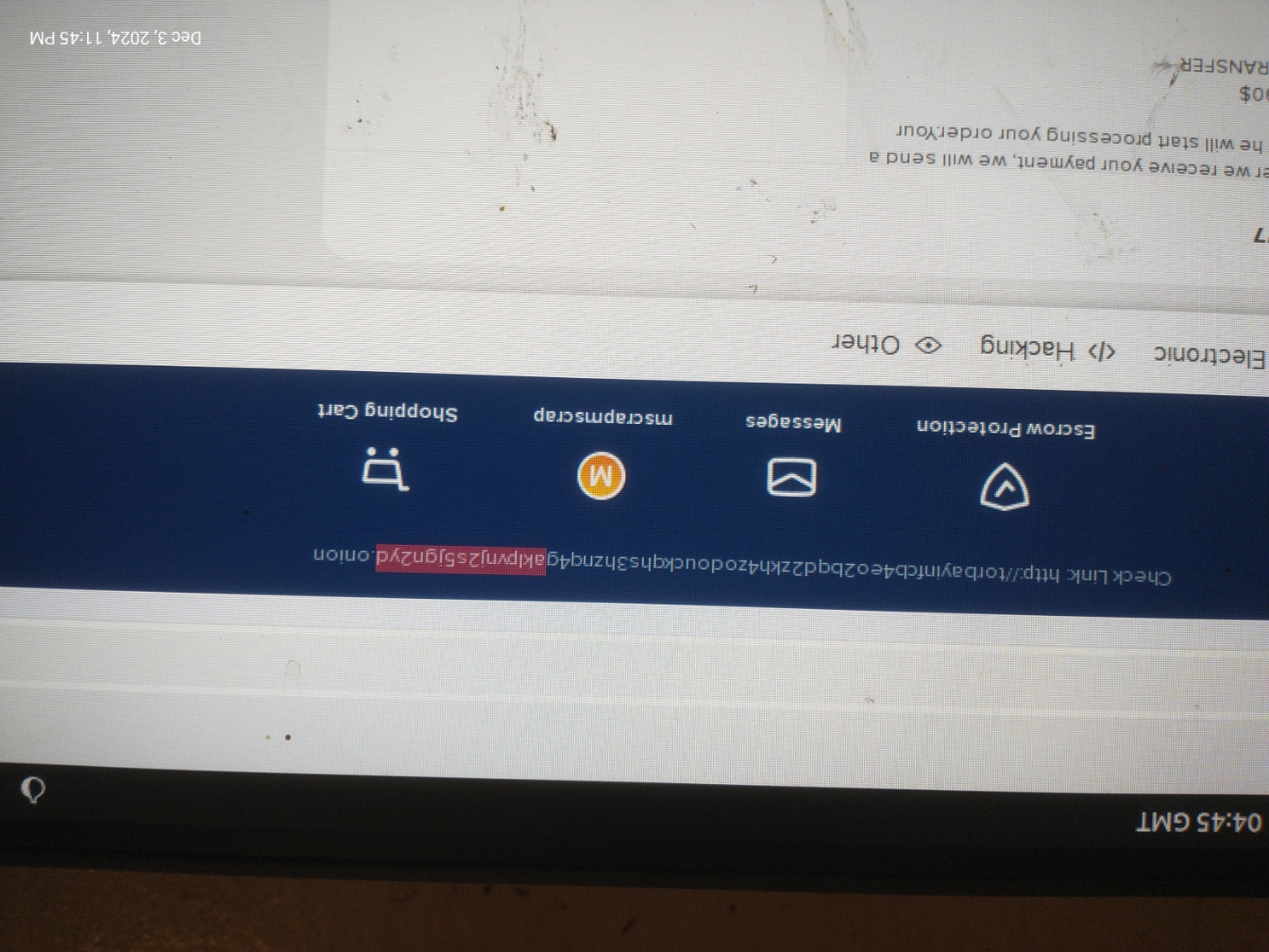

Onion Link : http://torbayinfcb4eo2bqd2zkh4zodouckqhs3hznq4gaklpvnj2s5jgn2yd.onion

Scam Report Date : 2024-12-05

Client Scam Report Breakdown

Original Scam Report :

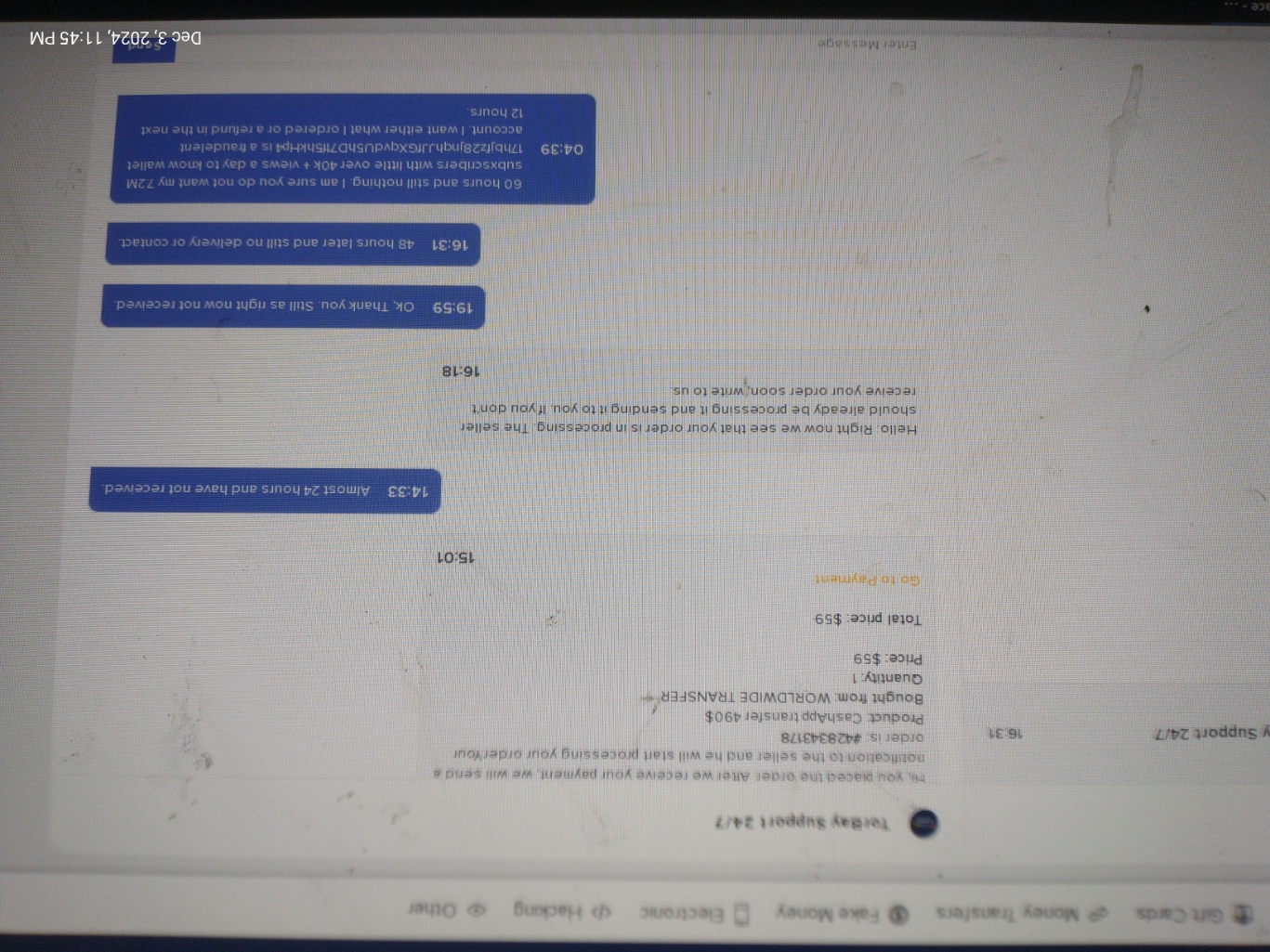

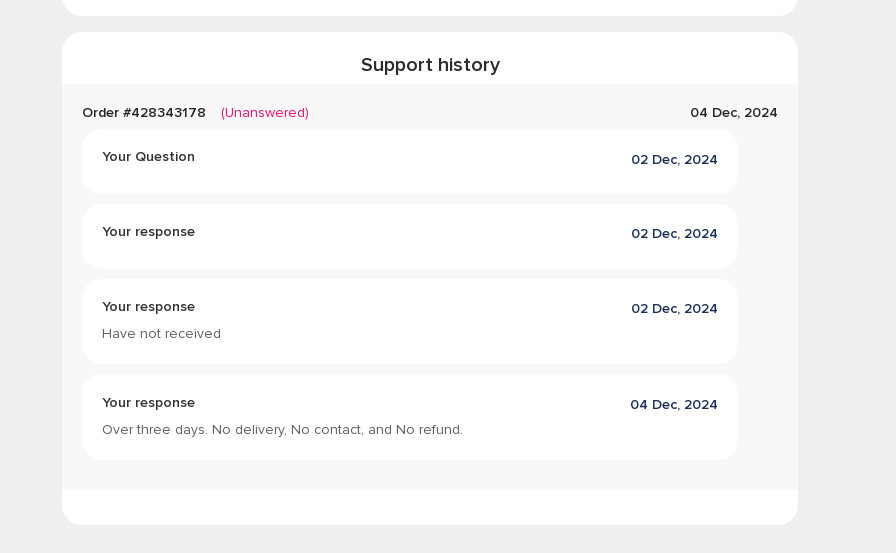

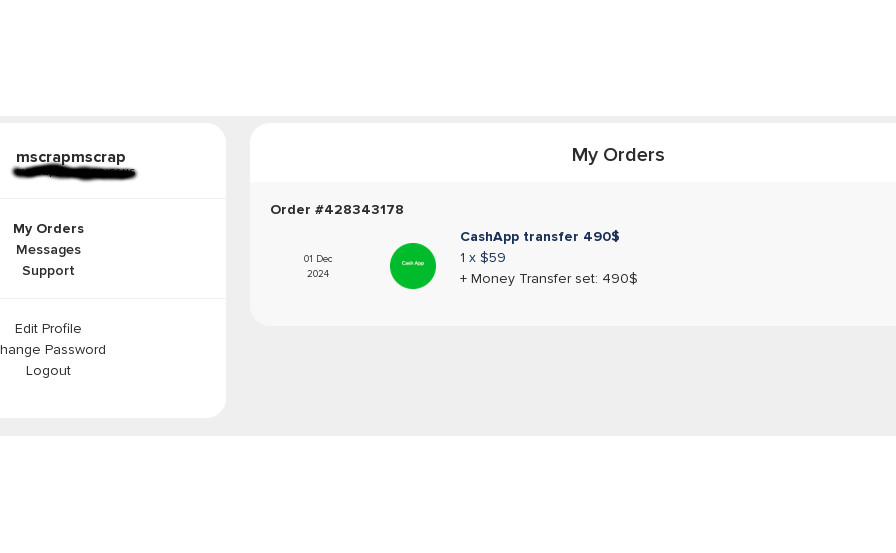

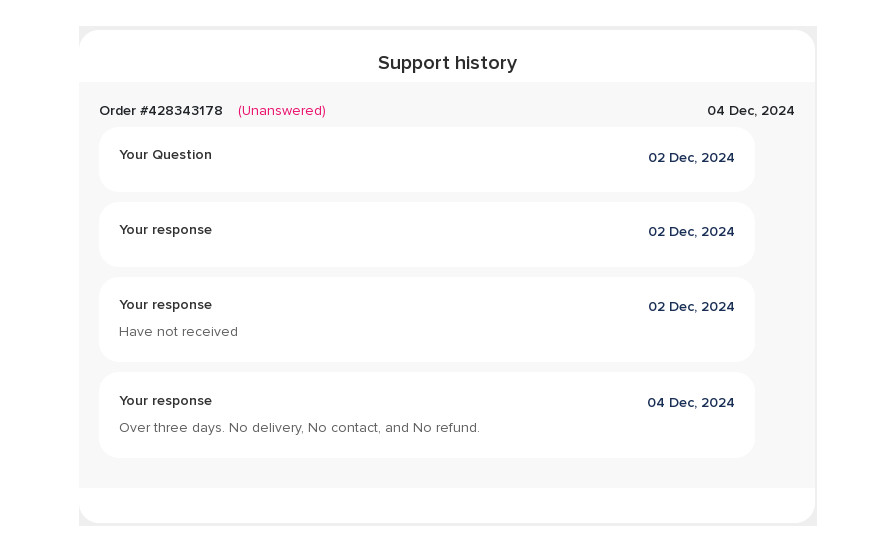

The client submitted a report detailing an experience with a scam involving a promised Cash App deposit. Specifically, the client stated: “In theory purchased a $490 Cash App deposit for $59 in BTC. I do not normally do things like this, however, it was to get some special little ones bikes for Christmas. Days later nothing.” This report indicates that the user attempted to purchase what was likely advertised as a discounted or fraudulent financial transaction. The seller promised a substantial Cash App deposit in exchange for a significantly smaller payment in Bitcoin (BTC). The report highlights that after completing the transaction, the client received nothing and was left without a response or resolution, marking it as a clear case of fraud.

The context of the report underscores the emotional stakes involved: the client was motivated by the desire to provide Christmas gifts for children, which likely influenced their decision to engage in a high-risk transaction. Unfortunately, the seller exploited the client’s circumstances and trust, a common tactic in online scams.

Photos :

2. Definition of Key Terms and Terminology

- Cash App Deposit: A financial transaction in which funds are added to a user’s Cash App account. In this context, it refers to an alleged deposit of $490 offered at a steep discount.

- Bitcoin (BTC): A decentralized digital currency used for peer-to-peer transactions. Bitcoin is frequently used in scams due to its pseudonymous nature and the difficulty of reversing transactions.

- Discounted Transactions: Offers where goods or services are provided at rates significantly lower than market value. Such deals often signal fraudulent intent, particularly in unregulated online markets.

- Fraudulent Financial Transactions: Schemes where a party promises financial benefits or transfers that are never fulfilled. These scams often exploit victims’ financial needs or desires for quick profits.

- High-Risk Transaction: A transaction involving minimal guarantees or protections, often carried out on unregulated platforms or through unconventional payment methods.

The client’s engagement in this transaction reflects several elements of high-risk online behavior. The significant price disparity (purchasing $490 for only $59) is a classic warning sign of a scam, as legitimate businesses cannot sustain such offers. Additionally, the use of Bitcoin as the payment method further limits recourse, as Bitcoin transactions are final and not easily traceable.

3. Implications and Analysis

This case exemplifies how scammers exploit individuals’ emotions, financial needs, or seasonal pressures to perpetrate fraud. In this instance, the client’s desire to provide Christmas gifts for children created a sense of urgency, likely impairing their ability to critically evaluate the legitimacy of the offer. The promise of a substantial return for a relatively small investment is a hallmark of financial scams, especially those targeting platforms like Cash App. Such schemes often rely on the anonymity of Bitcoin and the difficulty of tracing transactions to avoid accountability.

The report also underscores the importance of recognizing red flags in online transactions. Offers that seem too good to be true, such as heavily discounted financial benefits, are often fraudulent. Moreover, the use of cryptocurrency as a payment method should prompt users to exercise additional caution, as these payments typically offer no buyer protection. The lack of any response from the seller after the payment reinforces the conclusion that this was a deliberate scam.

To prevent similar experiences, individuals are advised to avoid engaging in discounted financial transactions that lack transparency or guarantees. Platforms like Cash App provide limited protection for transactions outside their standard processes, making it crucial to use verified methods and trusted sources. Additionally, during high-pressure times such as holidays, it’s important to remain vigilant and resist offers that seem disproportionately advantageous. This report serves as a sobering reminder of the vulnerabilities inherent in unregulated online transactions and the emotional toll scams can exact on victims.