Table of Contents

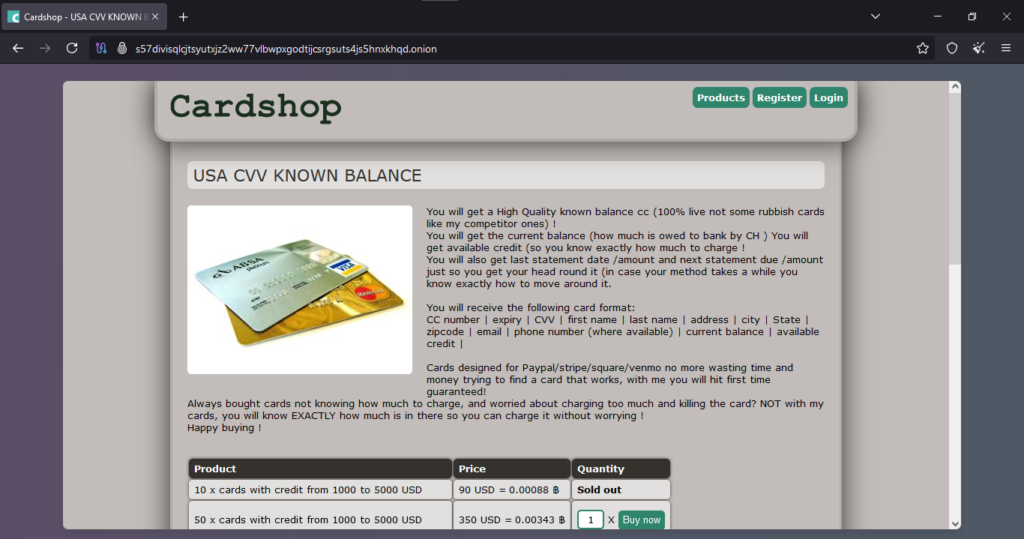

ToggleCardshop.cc – TOR Scam Report (127)

Onion Link : http://s57divisqlcjtsyutxjz2ww77vlbwpxgodtijcsrgsuts4js5hnxkhqd.onion/

Scam Report Date : 2025-01-24

Client Scam Report Breakdown

Original Scam Report :

The scam operation in question originates from a site called Cardshop, offering an array of fraudulent products, such as USA CVV Known Balance cards and worldwide credit card details from various countries, including the US, UK, DE (Germany), FR (France), CA (Canada), JP (Japan), AU (Australia), NL (Netherlands), IT (Italy), CH (Switzerland), DK (Denmark), and regions like the EU and Asia. The advertisement promises high-quality stolen credit card data, claiming the cards are “100% live” and superior to competitors. Specifically, the seller highlights that their cards include detailed financial data such as the cardholder’s current balance, available credit, last statement date/amount, and next statement due/amount. The report also emphasizes the cards’ compatibility with payment platforms like PayPal, Stripe, Square, and Venmo, purportedly ensuring successful fraudulent transactions without trial and error.

This scam is highly sophisticated, as it leverages detailed personal and financial information to facilitate fraud. The seller promises convenience and assurance to buyers, minimizing the risk of failed transactions and optimizing the card’s utility for fraudulent purposes. The inclusion of such granular data—beyond the usual card number, CVV, and expiration date—indicates a concerning level of data theft sophistication and coordination among cybercriminals.

2. Defining Terminology and Key Elements

To understand the scam fully, it’s essential to define the terminology used in the report:

- CVV: The Card Verification Value is a three-digit code on the back of credit cards used to verify the legitimacy of online transactions. In this context, CVVs are stolen and sold, enabling unauthorized online purchases.

- Known Balance Cards: These are stolen credit cards with information about the current balance (amount owed to the bank) and available credit. This information allows fraudsters to maximize charges without overdrawing the card, which might trigger alerts or declines.

- Last Statement Date/Amount & Next Statement Due/Amount: These details give buyers insight into the cardholder’s payment schedule, allowing them to time fraudulent transactions effectively, avoiding detection from the cardholder or bank.

- Paypal/Stripe/Square/Venmo: These are popular digital payment platforms that often act as intermediaries for transactions. The scam promises that the stolen cards will work seamlessly with these platforms, reducing the risk of failed payments that could flag fraudulent activity.

- High-Quality Cards: A marketing term used to imply the stolen cards are valid, active, and come with complete personal and financial information, increasing their usability for illicit purposes.

This scam capitalizes on providing fraudsters with all the data necessary to conduct targeted financial crimes, while eliminating the usual trial-and-error risks associated with stolen credit card use.

3. Segment Analysis and Implications

This scam report highlights a critical concern for cybersecurity and financial institutions: the increasing availability of stolen credit card information bundled with highly detailed financial data. By offering “known balance cards,” the scammer is making it easier for buyers to execute fraudulent transactions without raising red flags. The inclusion of current balances, available credit, and statement schedules transforms these stolen cards from generic tools into precision instruments for financial fraud.

Moreover, the compatibility with major platforms like PayPal and Venmo suggests that the scammer has tested these cards and identified gaps in the payment platforms’ fraud detection mechanisms. This raises questions about the robustness of these platforms’ security protocols and emphasizes the need for enhanced scrutiny and fraud detection measures. The marketing language used—”no more wasting time” and “hit first time guaranteed”—also illustrates how this scam exploits the trust and impatience of its criminal clientele, highlighting the professionalism and customer-focused approach within the cybercrime ecosystem.

Ultimately, this operation represents a dual threat: not only does it facilitate immediate financial harm to cardholders and institutions, but it also exposes systemic vulnerabilities that can be exploited on a larger scale. Addressing such scams requires a concerted effort from financial institutions, cybersecurity experts, and legal authorities to disrupt the underlying supply chains and enhance protective measures for consumers.