Table of Contents

Togglecardshop – TOR Scam Report (1)

Onion Link: http://s57divisqlcjtsyutxjz2ww77vlbwpxgodtijcsrgsuts4js5hnxkhqd.onion

Scam Report Date: 2024/03/18

Client Scam Report Breakdown

Original Report Summary:

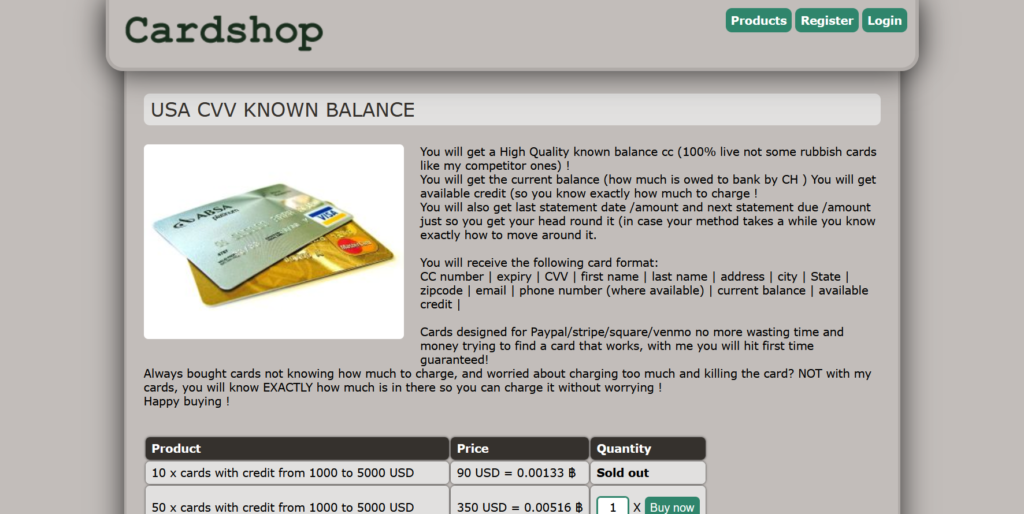

The user of the scam report claims, “they cheat my money and no feedback anymore,” which indicates that the transaction resulted in a financial loss and the seller ceased communication. This scam likely occurred on a dark web marketplace or a similar illicit platform where buyers seek fraudulent payment cards, such as CVVs and credit cards, that work for digital payment systems. In this case, the buyer believed they were purchasing a high-quality card with a known balance, but after the transaction, they experienced a loss of money and received no further support from the vendor.

From the scam report, it’s clear the buyer likely fell victim to one of the common tactics used in these illicit carding schemes: promising high-quality cards that never materialize. Based on the listing, the vendor boasted about the cards’ ability to work on platforms like PayPal, Stripe, Square, Venmo, and others, ensuring buyers would “hit first time guaranteed” when using the fraudulent credit cards. This type of scam is not uncommon in marketplaces dealing with illegal goods, where communication typically ends once the money is transferred. In this case, the victim received no response after paying, leading to a clear violation of the transaction trust.

Analysis and Terminology:

The term “CVV” refers to the Card Verification Value, which is a three- or four-digit code found on payment cards that is used to confirm the card’s authenticity during transactions, particularly in card-not-present scenarios such as online purchases. In the context of this scam report, the buyer expected to receive a working CVV for illicit purposes, with details such as the card’s available balance, statement information, and payment cycle. This level of specificity is often used by scammers to convince buyers they are getting a “high-quality” product, when in reality, the cards may be invalid or stolen, and the information provided is fabricated or incomplete.

The vendor also emphasized the term “non-AVS”, or non-Address Verification System, which means the credit cards do not require matching billing addresses to be used successfully. This is a common feature in fraudulent card schemes where buyers are told they can use any fake billing address when making purchases. This term was likely used as a selling point to appeal to buyers engaged in illegal activities who want to avoid the security checks that legitimate merchants use to prevent fraud. By promoting non-AVS cards, the vendor suggested their products would bypass common security protocols, further enticing the victim into a false sense of reliability and security.

Scam Techniques and Conclusion:

This particular scam, according to the client’s report, involved the vendor advertising that the buyer would receive credit cards with detailed financial data, including known balance amounts and statement information, thereby allowing the buyer to use the card without overcharging and depleting its available balance. However, after the money was transferred, the scam report reveals that the vendor disappeared and provided no feedback or support to the buyer. The initial promise of guaranteed success with payment platforms like PayPal and Stripe was likely a ruse to encourage buyers to believe they would be able to exploit these cards before the fraudulent nature of the transactions was detected.

This type of scam report highlights the common tactics of dark web sellers who operate in the carding industry: fake guarantees, detailed product descriptions that seem legitimate, and the promise of avoiding security measures like AVS. The complaint aligns with numerous other reports where buyers, eager to make illicit gains, are lured into buying worthless products. Once the payment is made, there’s typically no recourse, and the victim is left without a working card and no communication from the seller. The seller’s offer to provide detailed card information such as the statement date, available credit, and billing cycles was most likely fabricated, as these details are difficult to obtain even in illegal carding circles. This suggests that the scam was a front for a larger scheme to cheat multiple buyers with promises of guaranteed success using stolen or fraudulent credit cards.

In conclusion, the user’s complaint about being scammed reflects the classic techniques used in dark web carding operations: enticing buyers with too-good-to-be-true offers, providing detailed yet misleading information, and disappearing after receiving payment. By dissecting the scam report, it becomes clear how these vendors prey on buyers’ desires for illicit gains, only to cheat them in the process.