In the intricate world of online financial transactions, the term “Brians Club bins” frequently surfaces, yet it remains shrouded in ambiguity for many. Essentially, Brians Club bins refer to specific categories of credit card details sorted based on the issuing bank’s identification number—this number is part of what is known as the Bank Identification Number (BIN). These details are often exploited for unauthorized purchases and fraudulent activities, making them a pivotal concept in cybersecurity discussions.

Understanding Brians Club bins is crucial for several reasons. First, it empowers consumers and businesses to enhance their security measures and safeguard their financial information against potential threats. Awareness of how these bins operate and the common tactics employed by fraudsters can significantly reduce the risk of financial loss. Furthermore, comprehension of this topic contributes to overall financial health by helping individuals and corporations detect and prevent illicit activities within their transactions. In the following sections, we will delve deeper into the mechanics of Brians Club bins, explore their impact on financial security, and offer practical advice on protecting oneself from associated risks.

What Are Brians Club Bins?

Brians Club bins refer to a categorization system used in the underground economy to organize and sell stolen credit card information based on the Bank Identification Number (BIN). The BIN is the initial sequence of numbers on a credit card that uniquely identifies the institution issuing the card. Brians Club, a notorious entity in the cybercrime world, operates a marketplace where these stolen details are traded among cybercriminals.

Usage in Online Financial Transactions

In practice, Brians Club bins are primarily used in illicit online financial transactions. Cybercriminals purchase these bins to obtain bulk credit card details sorted by issuer, which they then use to execute fraudulent transactions or resell for profit. This method is particularly favored because it allows for targeted attacks; for instance, cards from specific banks might be chosen if they are known to have less stringent security measures or higher credit limits.

Legal and Ethical Considerations

The use of Brians Club bins raises significant legal and ethical issues. Legally, acquiring, selling, or using stolen credit card information is a criminal offense under various national and international laws. Perpetrators can face serious charges, including identity theft, fraud, and violations of cybersecurity laws. Ethically, the misuse of someone’s financial information causes not only financial harm but also psychological stress to the victims. It breaches fundamental ethical principles like honesty, fairness, and respect for others’ rights.

This background sets the stage for understanding the critical impacts of Brians Club bins on individuals and businesses globally, underscoring the importance of robust legal frameworks and ethical norms to combat this form of cybercrime effectively. In subsequent sections, we will discuss the operational mechanisms of Brians Club bins, their broader impact on financial security, and the measures that can be taken to mitigate their harmful effects.

The History of Brians Club

Brians Club is not just a singular entity but a part of a larger narrative that intertwines with the evolution of online fraud and cybercrime. It emerged as a notorious darknet marketplace where stolen credit card information is bought and sold. The platform gained infamy for its vast repository of credit card data, often sourced from hacking retail systems, phishing scams, or skimming devices. While the exact origins of Brians Club remain murky due to the secretive nature of such operations, it became widely recognized in the mid-2010s as a major player in the cybercrime arena.

Evolution of Credit Card Bins in Cybersecurity

The concept of credit card bins has been integral to the banking industry long before the advent of cybercrime, originally used to facilitate the sorting and usage of credit cards based on the issuing bank. However, with the digitalization of financial transactions, these bins gained new significance in cybersecurity.

Initially, bins helped merchants verify the authenticity of transactions, aligning certain bin numbers with specific banks and types of credit accounts. However, as online transactions grew, so did the sophistication of fraudsters. Cybercriminals began exploiting bins to streamline their theft operations, categorizing stolen card data by bins to maximize the success rate of fraudulent transactions. This practice allowed them to bypass certain automated security measures that rely on bin recognition to flag potential fraud.

The role of credit card bins in financial fraud has thus evolved from a functional tool in transaction processing to a double-edged sword, wielded also by cybercriminals to undermine the financial security of unsuspecting victims. The use of bins in cybercrime has prompted significant enhancements in cybersecurity measures, including advanced algorithms and tighter security protocols to detect and prevent bin misuse.

The historical perspective on Brians Club and the evolution of credit card bins provides a foundation for understanding the current challenges and methodologies in combating financial cybercrime. It highlights the ongoing battle between cybercriminals and cybersecurity professionals, underscoring the need for continuous innovation in security technologies and strategies.

How Do Brians Club Bins Work?

The operational mechanics behind Brians Club bins are both sophisticated and alarmingly streamlined, making them a formidable tool in the hands of cybercriminals. Essentially, the process involves several key steps:

- Data Collection: Brians Club obtains credit card data through various illegal means such as data breaches, phishing attacks, or using card skimmers. This data typically includes the credit card number, expiration date, CVV, and sometimes additional information such as the cardholder’s name and address.

- Data Organization and Categorization: Once the data is collected, it is organized into bins based on the Bank Identification Number (BIN). The BIN is the first six digits of a credit card number and identifies the institution that issued the card. This categorization allows buyers to purchase data in bulk according to specific banks or card types, which may be targeted for their higher limits or weaker security measures.

- Sale and Distribution: The sorted data is then listed for sale on the dark web marketplace like Brians Club. Buyers can search for and purchase credit card information based on specific criteria such as country, bank, card type, and even balance. Prices per card can vary based on these factors.

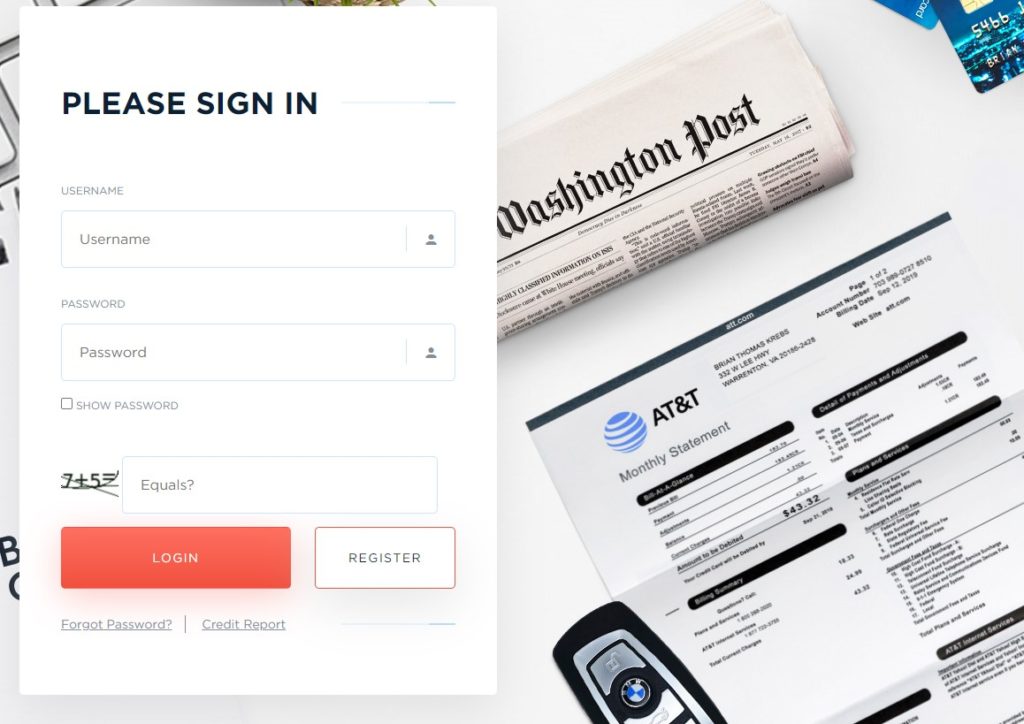

- Anonymization and Security: To secure transactions and anonymize the identities of buyers and sellers, Brians Club operates on the dark web and requires transactions to be conducted in cryptocurrencies, typically Bitcoin. This not only masks the identity of the parties involved but also complicates tracking by law enforcement.

Technology Used to Secure and Anonymize Transactions

Brians Club and similar platforms employ a variety of technologies to maintain security and anonymity:

- Tor Network: Access to Brians Club is typically via the Tor network, which anonymizes users’ locations and usage by routing connections through multiple servers around the globe.

- Encryption: Data stored on these platforms is heavily encrypted to prevent unauthorized access in the event of a breach. Communication between users is also encrypted to safeguard the details of their illegal transactions.

- Cryptocurrency Payments: By utilizing cryptocurrencies, these platforms take advantage of the inherent security features of blockchain technology, which provides an additional layer of anonymity and is difficult to trace compared to traditional banking transactions.

These technologies create a robust system that not only facilitates the sale of stolen credit card data but also significantly hinders efforts to shut down such operations or track down the individuals involved. This underscores the challenges faced by law enforcement and cybersecurity professionals in combating credit card fraud originating from platforms like Brians Club.

The Impact of Brians Club Bins on Financial Security

The proliferation of platforms like Brians Club has a profound and destabilizing effect on financial security worldwide. By facilitating the widespread availability of stolen credit card data, these operations contribute significantly to the global issue of financial fraud. Below are some statistics and real-world case studies that illustrate the extent and impact of such activities.

Table of Contents

ToggleStatistical Data on Financial Fraud Involving Brians Club Bins

- Volume of Stolen Data: Brians Club reportedly had over 9.1 million stolen credit card records for sale in its database by late 2019, a clear indicator of the extensive reach of this type of cybercrime.

- Financial Losses: In 2020 alone, financial losses from credit card fraud in the United States were estimated to total around $11 billion. While not all these losses stem directly from Brians Club, the platform and others like it play a significant role in perpetuating this fraud.

- Global Reach: The data available on platforms like Brians Club often spans multiple countries, indicating that the impact of such cybercrime is not limited by geographic boundaries. For instance, credit card details from users in over 100 countries have been found on similar sites.

Real-World Case Studies of Fraud and Its Impact on Victims

- Case Study 1: Small Business Hit by Fraud: A small online retailer in the U.S. fell victim to a series of fraudulent transactions totaling over $50,000. Investigation revealed that the credit card details used were available for purchase on Brians Club. The financial strain nearly led to the business’s closure, and the emotional toll on the owners was significant, highlighting the devastating effects of such fraud on small businesses.

- Case Study 2: Individual Victim of Identity Theft: An individual in Canada discovered that their credit card had been maxed out with transactions they did not recognize. Further investigation linked the unauthorized use of their card to a data set available on Brians Club. The victim faced a lengthy process of securing their financial data and recovering from the credit score damage caused by the fraud.

These examples underscore the dual impact of Brians Club bins on both personal and professional levels. Financially, victims face significant losses and the daunting task of securing their data. Emotionally, the breach of personal financial security can lead to stress and a pervasive sense of vulnerability.

Preventative Measures and Best Practices

In the face of increasing threats from platforms like Brians Club, both individuals and financial institutions need robust strategies to protect themselves against fraud. Here are some essential tips and best practices to mitigate the risks associated with stolen credit card information.

Tips for Individuals to Protect Themselves from Fraud

- Monitor Financial Statements Regularly: Check your bank statements and credit card transactions frequently to spot any unauthorized activity early. Many banks offer notification services for any transactions, which can be an effective early warning system.

- Use Credit Monitoring Services: Enroll in credit monitoring that alerts you to any suspicious activity linked to your credit profile. This can help catch attempts to open new credit accounts in your name.

- Enable Two-Factor Authentication (2FA): Wherever possible, activate 2FA on your financial accounts. This adds an additional layer of security, making it more difficult for unauthorized users to gain access even if they have your card details.

- Be Wary of Phishing Attempts: Educate yourself about the tactics used in phishing scams and be cautious with emails or messages requesting personal information. Always verify the authenticity of requests through direct contact with the institution.

- Secure Your Personal Information: Be mindful of where and how you share your credit card information. Avoid entering sensitive data on unsecured or public Wi-Fi networks.

Best Practices for Financial Institutions to Detect and Prevent Unauthorized Use of Credit Card Bins

- Enhanced Authentication Methods: Implement advanced authentication mechanisms, such as biometrics or dynamic passcodes, particularly for high-risk transactions or changes to account information.

- Real-Time Transaction Monitoring and Analytics: Use sophisticated algorithms and machine learning to monitor transactions in real-time for any signs of fraudulent activity. Anomalies can be flagged instantly for further investigation.

- Employee Training and Awareness: Regularly train staff on the latest cybersecurity threats and fraud detection techniques. Employees are often the first line of defense against fraud.

- Fraud Detection Infrastructure: Invest in state-of-the-art fraud detection systems that can analyze patterns and predict potential fraud based on deviations from normal transaction behaviors.

- Collaboration with Other Financial Entities: Work collaboratively with other banks and financial institutions to share information about emerging threats and fraudulent patterns. This collective approach can help prevent wider exploitation of stolen data.

- Customer Education Programs: Regularly inform customers about fraud risks and preventive measures. Educated customers are less likely to fall victim to fraud and more likely to report suspicious activities promptly.

Legal Consequences and Regulations

The misuse of credit card information, particularly through platforms like Brians Club, carries severe legal consequences under various jurisdictions, with the United States having a robust framework of laws and regulations aimed at deterring and penalizing such offenses.

Legal Consequences for Misuse of Credit Card Information

- Criminal Charges: Individuals involved in the theft, purchase, or use of stolen credit card information can face multiple criminal charges, including identity theft, wire fraud, and computer fraud. These charges can result in substantial fines and lengthy prison sentences. For example, under U.S. federal law, identity theft can carry a penalty of up to 15 years in prison, while wire fraud charges can lead to up to 20 years for each act of fraud.

- Civil Penalties: Victims of credit card fraud (both individuals and institutions) may sue the perpetrators to recover damages. These civil actions can result in the payment of restitution and other damages to the victims.

- Asset Forfeiture: The government may seize assets derived from or used in the commission of credit card fraud. This includes any proceeds from the sale of stolen credit card data or property purchased with fraudulent funds.

Current Regulations and Laws in the United States Regarding Credit Card Fraud and Data Protection

- The Fair Credit Billing Act (FCBA): This act provides consumers with a mechanism to resolve discrepancies and fraudulent charges on credit card bills, offering significant protection against the financial impact of fraud.

- The Electronic Fund Transfer Act (EFTA): EFTA protects consumers when they transfer funds electronically, including ATM withdrawals and the use of debit cards, and provides a framework for correcting errors in these transactions.

- The Gramm-Leach-Bliley Act (GLBA): This law requires financial institutions to explain their information-sharing practices to their customers and to safeguard sensitive data.

- The Payment Card Industry Data Security Standard (PCI DSS): While not a law, PCI DSS is a regulatory standard for organizations that handle branded credit cards from the major card schemes. Non-compliance can result in hefty fines from credit card companies and banks.

- Identity Theft and Assumption Deterrence Act: Enacted to address the growing problem of identity theft, this law expanded the definition of identity theft and ensured that it includes information related to electronic identification.

Future of Credit Card Security

The landscape of credit card security is rapidly evolving, driven by technological advances and the need to stay ahead of sophisticated cybercriminals. Here’s a look at the current innovations and trends in credit card security, as well as some predictions on how the threat from platforms like Brians Club might be addressed or mitigated in the future.

Innovations and Trends in Credit Card Security

- Tokenization: One of the most promising advances in credit card security, tokenization replaces card details with a unique digital token in transactions. This method greatly reduces the risk of card details being stolen during a transaction as the actual card numbers are never exposed.

- Biometric Verification: Adding an additional layer of security, biometric features like fingerprint scanners, facial recognition, and voice authentication are being integrated into credit card authentication processes. This technology helps to ensure that only the authorized user can approve transactions.

- Advanced Encryption Standards: New encryption methods, including quantum-resistant algorithms, are being developed to protect data even with the advent of quantum computing, which could potentially break many of the current encryption techniques.

- Artificial Intelligence and Machine Learning: These technologies are being increasingly used to detect fraudulent activities by analyzing spending patterns and flagging anomalies in real-time, which can help in preventing fraud before it occurs.

- Contactless Payments: With the rise of Near Field Communication (NFC) and RFID technology, contactless payments are becoming more common, reducing the physical handling of cards and thus the opportunities for skimming and cloning.

Predictions on How Brians Club Bins Might Evolve or Be Curbed

- Regulatory Enhancements: As cyber threats evolve, so too do regulatory frameworks. We can expect more rigorous international cooperation and stronger laws that specifically target the sale and purchase of stolen credit card data, making operations like Brians Club more risky and less profitable.

- Decentralized Identity Systems: Future security measures may involve decentralized identity solutions, where individuals have control over their identity data stored on blockchain systems. This can potentially eliminate the need for storing sensitive information with merchants, thereby reducing the risk of large-scale data breaches.

- Global Blacklist Sharing: Financial institutions might develop a more robust system for sharing information about compromised bins and cards across borders. By leveraging blockchain technology, this shared ledger of data can be both secure and transparent, preventing fraudsters from using stolen data across different countries.

- Advanced Anomaly Detection Systems: As AI and machine learning evolve, these systems will become more adept at detecting and responding to fraudulent transactions in real-time, potentially identifying and stopping fraud even before the user notices.

- Consumer Awareness and Training: Increased consumer education about security practices and the risks of cyber fraud will play a critical role in mitigating the impact of Brians Club bins. As consumers become more vigilant, the efficacy of stolen data for fraud decreases.

Conclusion

Throughout this discussion, we’ve explored various aspects of Brians Club bins and their implications for financial security and cybercrime. Here’s a brief summary of the key points covered:

- Understanding Brians Club Bins: We defined Brians Club bins and explained their role in organizing stolen credit card information for sale based on Bank Identification Numbers (BINs). This categorization facilitates targeted fraud.

- History and Evolution: We delved into the history of Brians Club, noting its emergence as a significant player in the dark web marketplace and its contribution to the evolution of credit card fraud.

- Operational Mechanisms: The process by which Brians Club bins operate was outlined, emphasizing the sophisticated methods used to collect, organize, and sell stolen data, along with the technologies employed to secure and anonymize these transactions.

- Impact on Financial Security: We highlighted the significant financial and emotional impacts of fraud involving Brians Club bins through statistical data and real-world case studies, illustrating the wide-reaching consequences of such cybercrimes.

- Preventative Measures: Recommendations for individuals and financial institutions were discussed, focusing on proactive measures like regular monitoring, using advanced security technologies, and educating stakeholders about potential risks.

- Legal Frameworks: The stringent legal consequences and regulatory measures currently in place to combat credit card fraud in the United States were examined, showcasing the efforts to mitigate these illegal activities.

- Future of Credit Card Security: Innovations in credit card security and predictions about the future were explored, noting the potential technological advancements that could curb or completely phase out the effectiveness of operations like Brians Club.